- So, this is adulting by DoitDuit

- Posts

- The fall of Nike and the rise of ON, HOKA and ASICS

The fall of Nike and the rise of ON, HOKA and ASICS

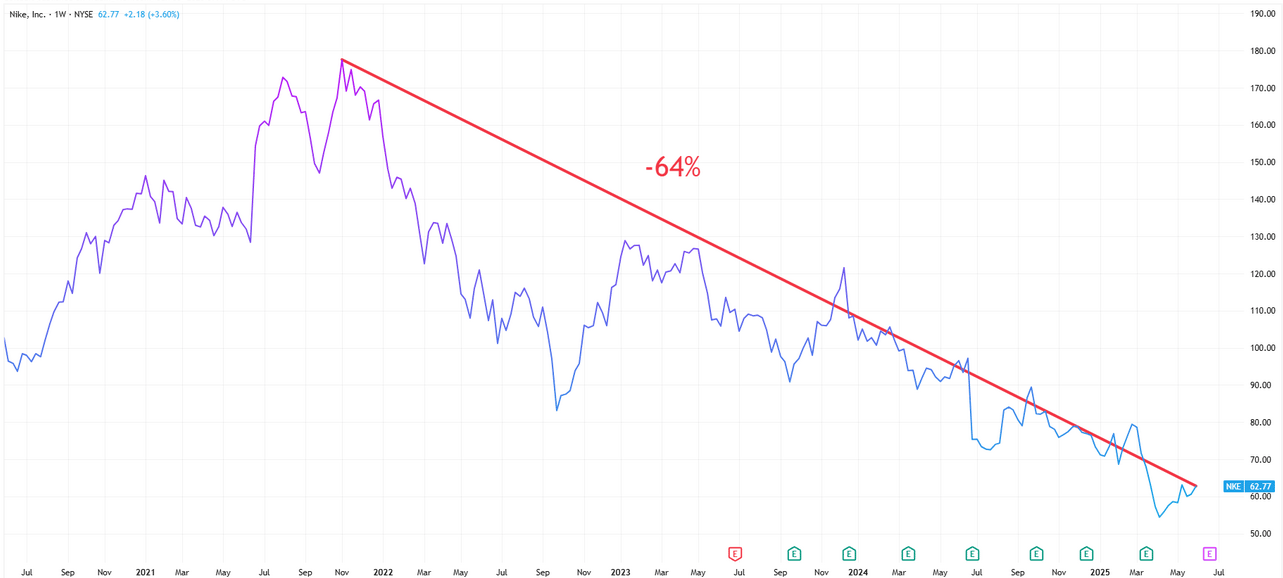

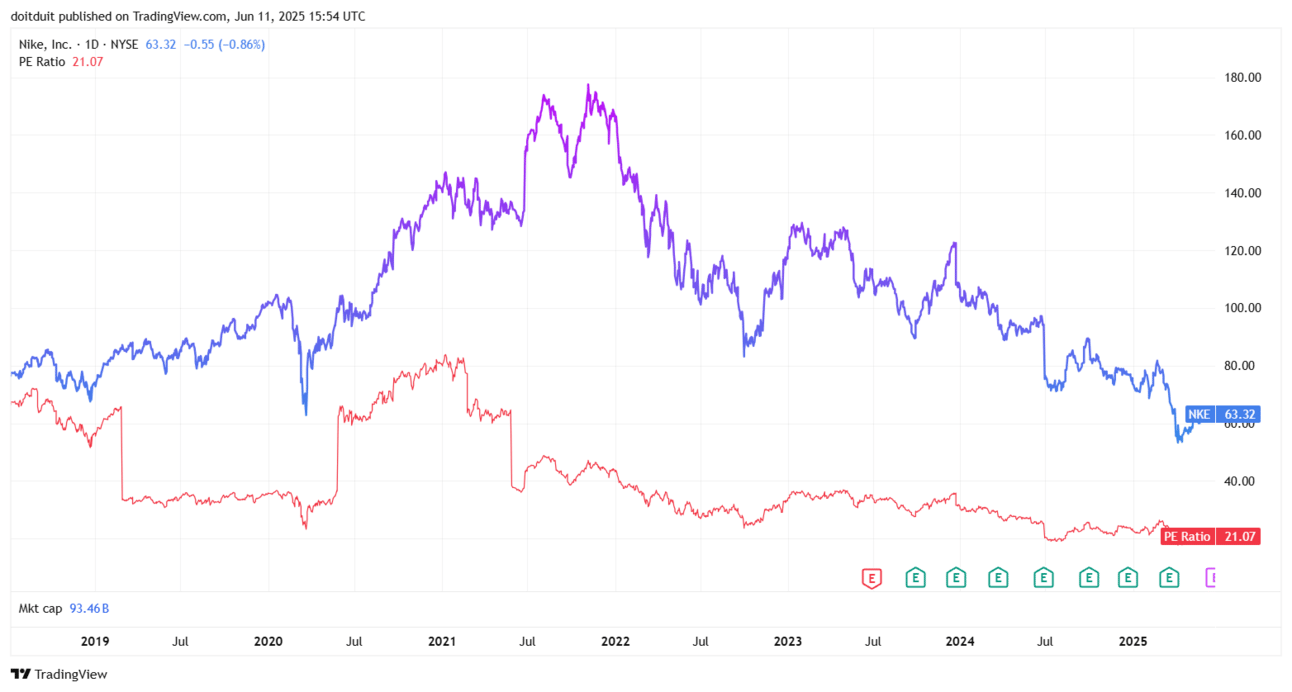

Nike share price has crashed -64% since Nov 2021, is there an opportunity here?

Paid subscribers can listen to this exclusive content after logging into doitduit.com.

Share price of Nike for the past 5 years (from June 2020 to June 2025)

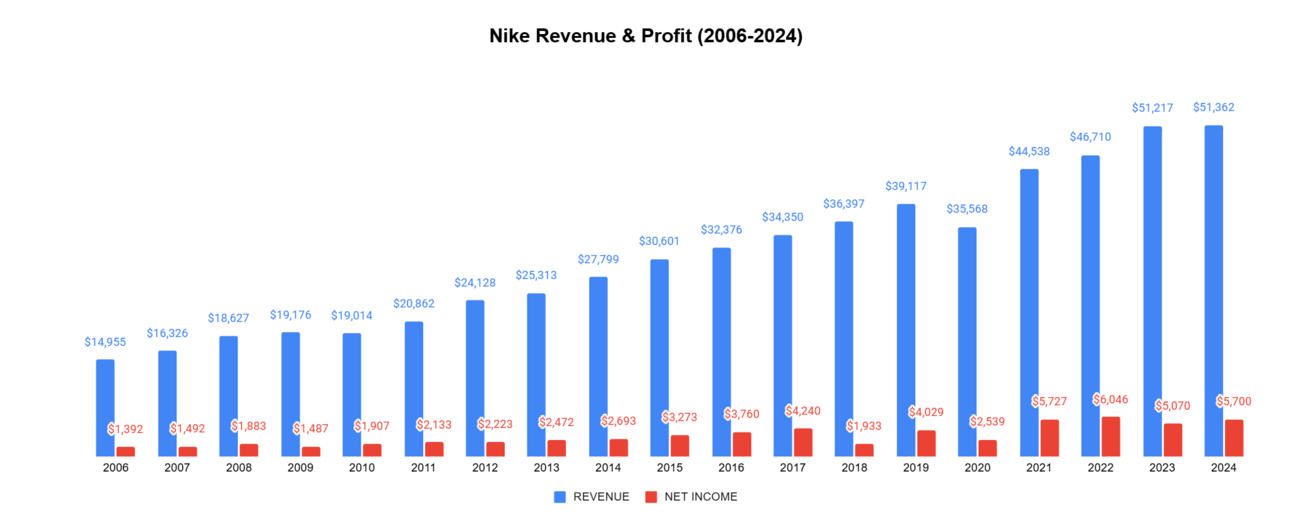

Since Nike hit its peak market capitalisation of US$300 billion on 1 Nov 2021, today Nike’s market capitalisation has dropped 64% to US$95 billion from its peak (as of 5 June 2025).

What happened and is there an opportunity here?

— — — —

The rise of Nike

Phil Knight (left) and Bill Bowerman (right)

Nike was founded by Phil Knight and Bill Bowerman who both were track athlete. Before that, both of them already started a business of importing Onitsuka Tiger shoes from Japan to resell it in the US. Phil and Bill will also give suggestions/designs to Onitsuka Tiger team to redesign/modify the shoes.

Similarities between Nike and Onitsuka Tiger in the early years (and this has led to legal battles between the two giants)

However, Onitsuka Tiger was slow in implementing their suggestions, so Phil and Bill launched their own brand, Nike in 1971. Nike achieved revenue of US$2 million in its first year, US$14.1 million in 1976 and US$270 million in 1980. Huge growth.

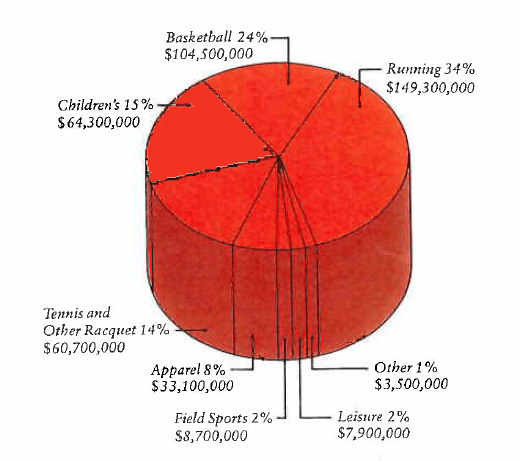

Because of Phil and Bill’s close relationship with athletes in the US, they gave many athletes Nike shoes and when these athletes won championships, Nike will get free publicity. Nike first found of success was in the running category, which then expanded to the basketball and tennis category.

Sales % of Nike based on their 1981 annual report

In 1980, Nike went IPO with Phil selling its share to cash out approximately US$18 million. Their biggest competitor at that time was Reebok shoe, which was big in gymnastics, tennis, and basketball segment. Reebok sales were higher than Nike at one point.

After the IPO, Nike’s plan was to expand into the sports apparel segment and casual shoe market. They failed in both, resulting in Nike needed to write off their inventory (22 million pairs of shoes sold at deep discounts) due to bad demand and their first ever quarterly loss in 1984 (and another subsequent quarterly loss to stop the bleed).

Michael Jordan (left), 1st Air Max (middle), 1st “Just do it” Campaign (right)

Nike’s turning point came in the period of 1985 to 1990s, where Nike hit 3 gold mines:

Successfully signed Michael Jordan in 1985 and created the iconic “Air Jordan" sub-brand;

Introduced Air Max product line in 1987, an iconic innovation by their R&D team; and

“Just do it” campaign in 1988 to appeal to a wider audience, other than their niche elite athletes audience.

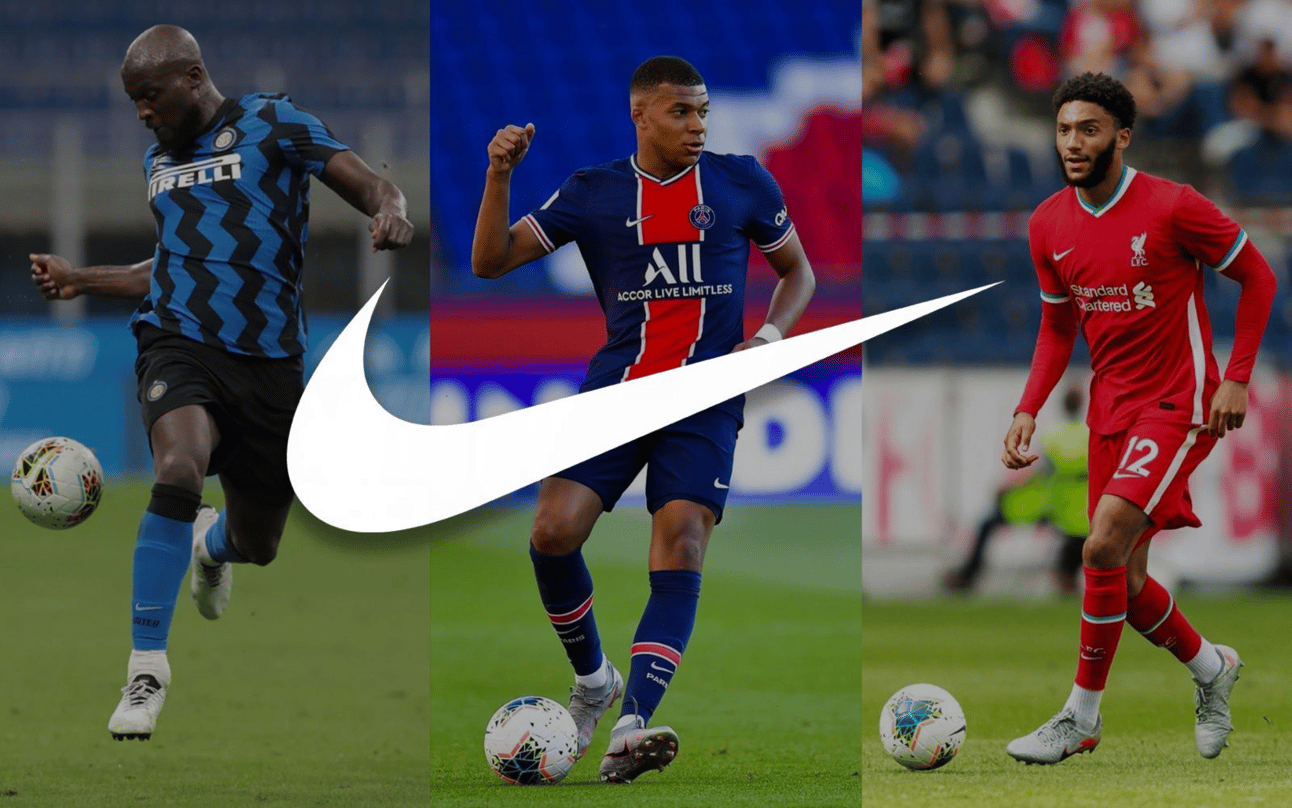

Nike sponsorship of major sport events and top athletes is everywhere

Since then, Nike found their success formula and copy pasted this whenever they enter a new sport segment or a new country:

Sponsor and hire the top athletes as brand ambassadors;

Sponsor big sports events;

Impactful campaign for branding; and

Innovate and R&D on technology to continuously introduce new great product.

Growth in Nike revenue and profit follows with this strategy.

— — — —

Nike Business Model

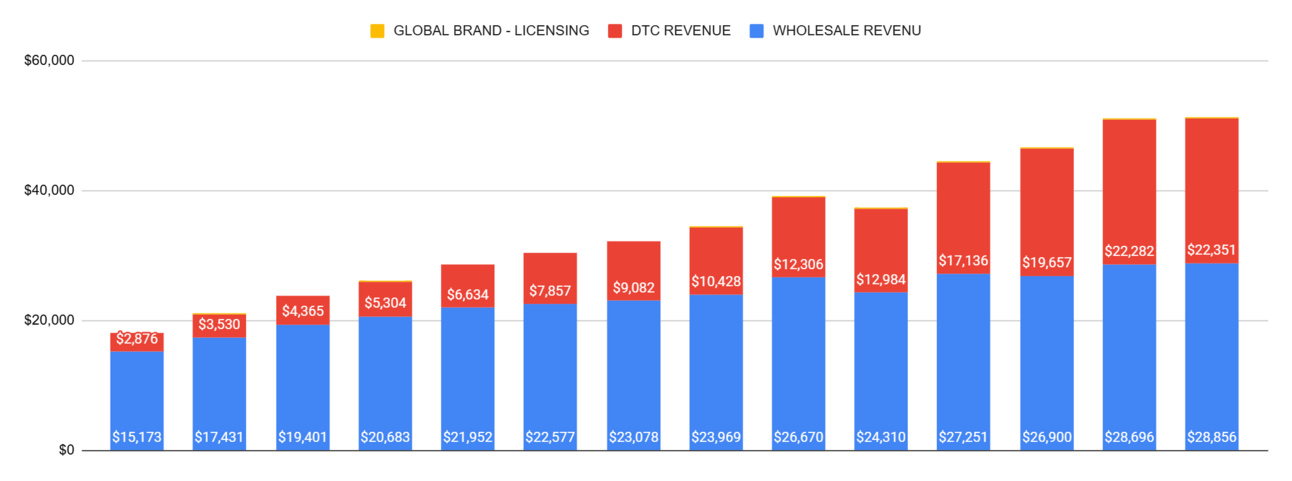

Nike generates sales from 2 main sources:

Wholesale channel: Nike shoes sold in Dick's Sporting Goods, JD Sports, FootLocker etc

Direct-To-Customers (DTC) channel: Physical Nike self-operated stores, Nike.com and Nike+ app

Nike DTC store

Since the introduction of smartphone, the world started entering the digital era. Nike invested heavily into their direct-to-customer (DTC) channels, i.e. their own Nike store, Nike+ app and Nike.com.

Nike loves the DTC business model because of 2 reasons:

Nike can earn much higher margin; and

Nike can control the customer experience directly.

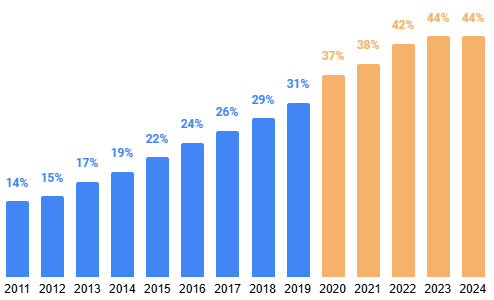

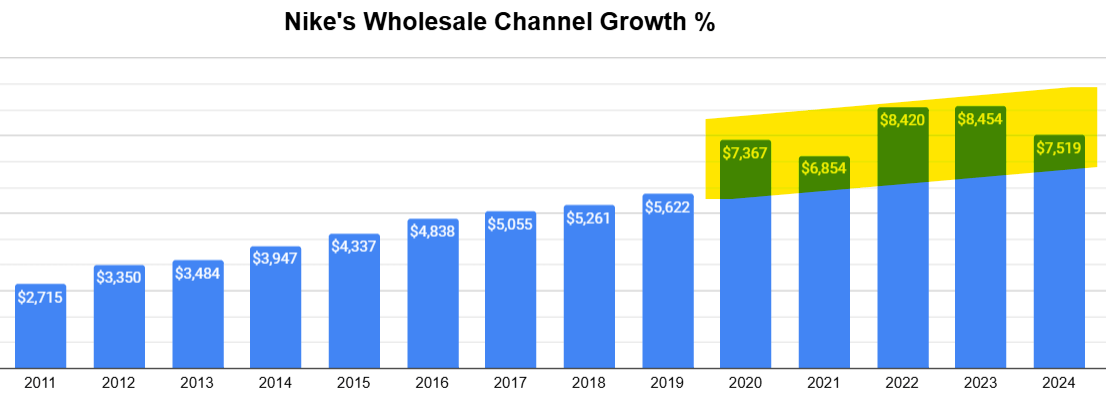

Contribution of DTC vs Wholesale to Nike from 2011 to 2024

The heavy investment into Nike+ and Nike.com yield very good results. From 2011 to 2024, Nike’s revenue from direct-to-consumer grew 15.7% CAGR vs Nike’s revenue from wholesale that grew only 4.7% CAGR. Over time, Nike is obsessed with their DTC channel.

— — — —

Nike Push for DTC

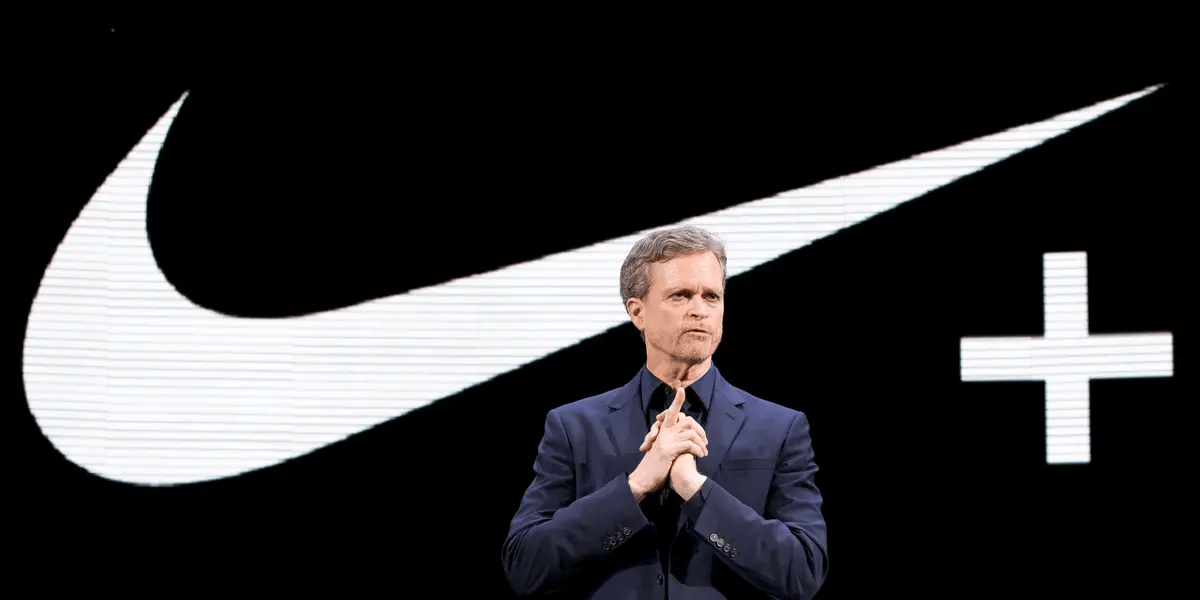

Mark Parker with his Consumer Direct Offense strategy

In 2017, Nike launched “Consumer Direct Offense” strategy under Mark Parker, with 3 main strategy pillars:

2X Innovation: Cut 25% of the product lines and only focus on iconic and high-potential product line;

2X Speed: Cut entire production timeline from years to months; and

2X Direct: Double down on DTC channel + new membership.

As a consequences of this, in November 2019, Nike pulled out from Amazon and stop selling their products on Amazon directly.

Mark Parker with his Consumer Direct Acceleration strategy

In January 2020, Nike’s board hired John Donahoe with e-commerce experience (eBay, ServiceNow) as CEO. John Donahoe launched “Consumer Direct Acceleration” as Nike’s main strategy, which DTC channel became the whole strategy for Nike company. This was in contrast to the “Consumer Direct Offense” strategy where DTC channel is only part of the strategy.

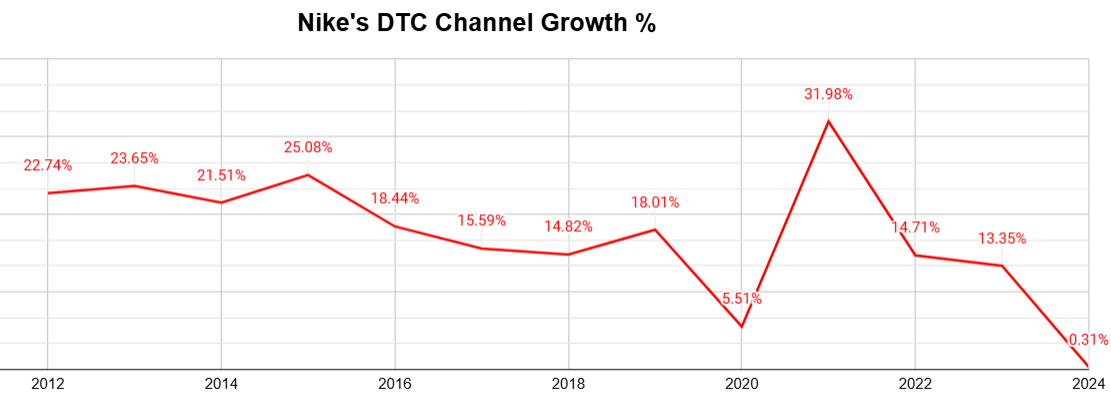

Nike DTC channel revenue contribution from 2011 to 2024

Since then, Nike’s DTC channel contribution to total sales grew from 31% in 2019 to 44% in 2024.

— — — —

Nike’s downfall

Everything looks great, until it doesn’t. This new “Consumer Direct Acceleration” strategy resulted in 3 big changes:

In 2021, Nike dropped 50% of its wholesale partners, including DSW, Macy’s, Urban Outfitters and Olympia Sports;

Nike significantly reduced supplying its best product to its remaining wholesale partners; and

Nike focused on acquiring sales via targeted performance advertisement instead of their usual “branding marketing”.

This was a big wake up call for the wholesalers, because a lot of their sales are heavily reliant on Nike, i.e. Nike products accounted for 75% of FootLocker sales in 2020. The wholesalers scrambled to reduce their reliance on Nike, and started to showcase other brands and/or emphasis on building their own private-label brands.

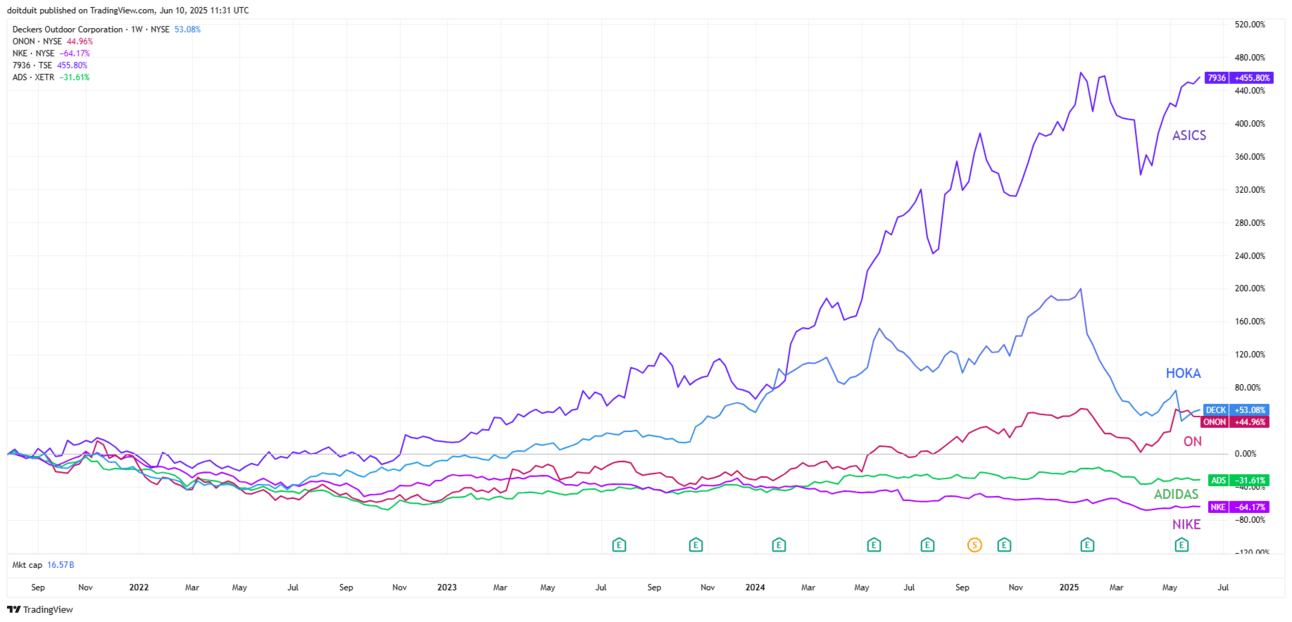

Share price performance of Nike vs its competitors

Many brands were displayed on shelf and came into consumers’ eyes during this period of time, i.e. ASICS, New Balance, Onitsuka Tiger, ON, HOKA etc. The sales of these shoe brands improve significantly after Nike dropped half of its wholesale networks.

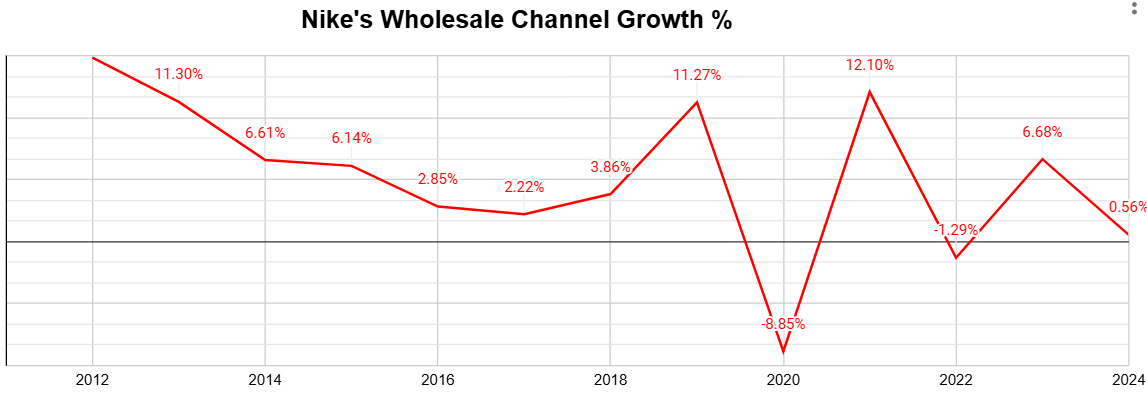

Nike’s wholesale channel growth turned negative in FYE2022

In FYE 2022, after implementing “Consumer Direct Acceleration” strategy for 1 year, Nike’s wholesale channel sales declined -1%, for the first time since 1999 (excluding FYE2020 Covid Year). The US wholesale channel sales declined -6% while the overall China sales declined -9%.

Nike’s inventories start to build up fast, especially in 2022

Without the wholesalers, Nike’s inventories started to build up fast, and this alarmed Nike’s management. They need to sell them off fast, or else they will repeat their 1984 mistake, so Nike did 2 things:

Reconnected with some of the wholesalers they dropped, i.e. DSW and Macy’s; and

Gave heavy discounts to their Nike products to reduce their inventories.

In FYE2023, Nike’s wholesale channel sales turnaround and grew +7%. The US wholesale channel sales grew +17% while the overall China sales continue to decline -4%. Nevertheless, gross margin dropped 2% because Nike was giving heavy discounts to sell off products.

Nike’s DTC channel growth plummet in FYE2024

In FYE 2024, this is the year of reckoning for Nike because even their DTC channel growth slowed down to +0.3% (from +13% in FYE2023). The US wholesale channel sales declined again -2%, while overall China sales improve slightly +4%.

The “Consumer Direct Acceleration” strategy is a failure and costs Nike’s their innovative brand image. Share price reflected the reality, down 64% since 1 Nov 2021.

— — — —

What can we learn?

There are many lessons we can learn here:

1. Brand value

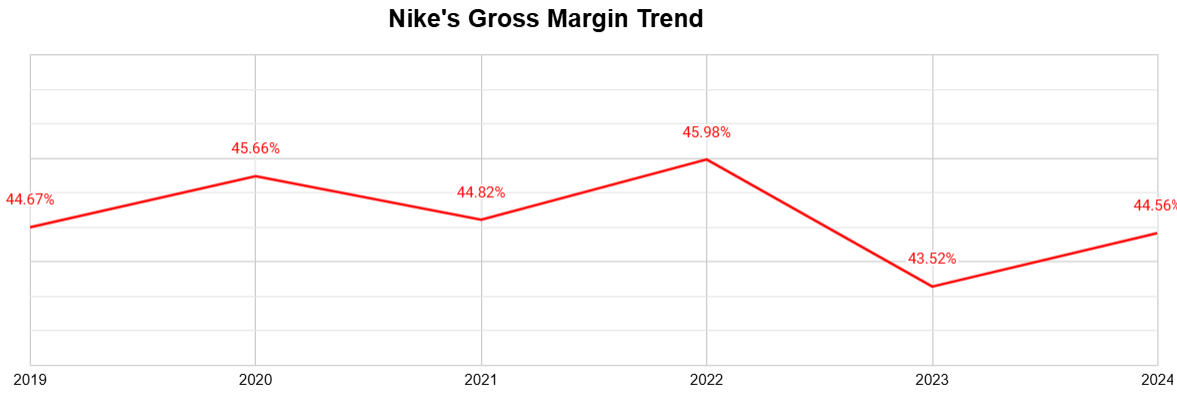

Business that focus on value creation should think and invest for the long term. What makes people love and pay a premium for Nike brand is their brand image of product innovation and “Just do it” mentality. This DTC strategy has shifted Nike’s strategy from pull marketing into push marketing, which led to Nike’s brand value dropping.

Because of the focus on digital channel, Nike made 2 big changes:

Nike shifted their marketing budget from brand building to acquiring customers via ads. This means that Nike has lost their physical store operating leverage, because ads payment are paid on conversion. Nike needs to pay Meta a percentage of the sales (around 10-20%) for every sale converted from ads. This is in big contrast when Nike just need to pay a fixed rental, and earn more when they sell more.

Nike shifted their focus from expanding their customer base, to increasing Nike customers’ “lifetime value”. Their marketing team started to keep all Nike’s best promotion/products/launch to Nike members only. After you become a Nike member, their marketing team will then reengage and hard sell you their other products. Imagine Hermes lost their cool and hire salesmen to hard sell you their products, would you still perceive Hermes as a premium brand?

Nike’s gross profit margin trend from 2019 to 2024

The result is obvious, not only that Nike failed to improve their margin as expected from their shift of focus to DTC channel, the perceived brand value of Nike also dropped.

2. Distribution is king

No brands last forever, it takes 20 years to build a reputation and five minutes to ruin it.

Distribution is very important for all types of business, especially retailers. You want to be where your customers are.

ON occupied wholesalers’ shelf space when Nike dropped their wholesalers

This is important because the brand needs to occupy their customers’ mindshare. Nike dropping their wholesalers opened up the opportunity for the wholesalers to showcase their competitors’ brand. This helped their competitors to snatch away Nike customers mindshare.

3. The default option

Nike ads increased after Nike go all out on DTC strategy

Nike’s choice to move to DTC creates a problem for their customer: they need to intentionally go to Nike.com, or Nike physical store to buy a Nike products. This intentionality creates friction for their purchasing process.

Nike used to be the default option for many who visited shoe stores

A big portion of Nike’s customers are used to buying Nike products when they are shopping around FootLocker or DSW. The decision to purchase a Nike shoe was simple and straight-forward - in a sea of shoe brands, Nike’s strong brand presence make them choose Nike shoes on default. Nike eliminated this option from their sales channel, and eliminated this group of customers.

This lesson can be cross-applied in many areas. One strong example is Google paying Apple US$20 billion just for Apple to let Google because the default search engine options for all Apple devices, even when Google is already super dominant. This is Google understanding the power of default, and the importance of minimising friction for their customers.

— — — —

What is Nike doing now

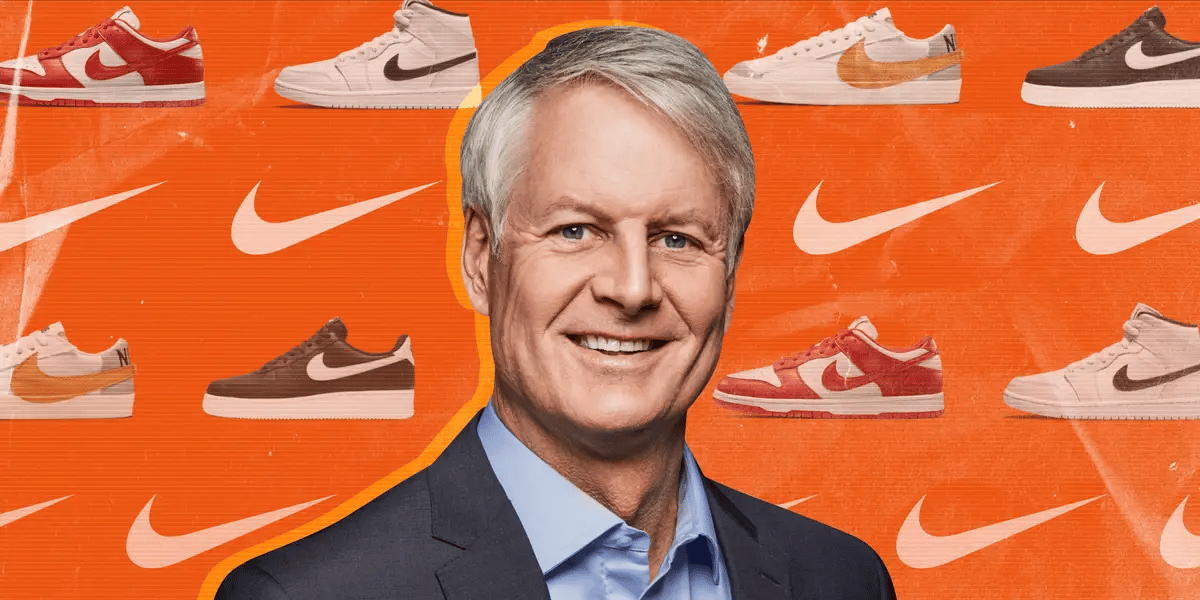

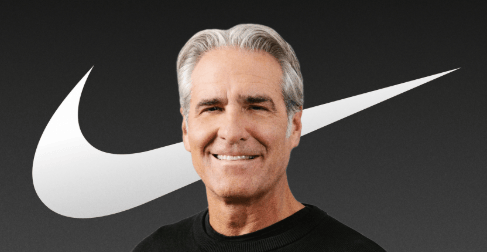

Eliot Hill became Nike CEO, he started working in Nike since intern

After seeing $205 billion market value evaporated, Nike’s board finally fired John Donahoe and hire Elliot Hill to correct their mistake. Elliot Hill came up with a new strategy, “Win Now” with 5 priority actions:

Ignite our Winning Culture: Restart Nike’s brand building marketing efforts.

Shaping Nike brand for distinction: Nike is back to sponsoring and appearing in more sports events/competitions, i.e. Superbowl and NBA All-Stars.

Accelerate a complete product portfolio: Expand their product lines that were cut in the previous strategy, and reduce reliance on iconic product lines that ended up diluting the brand value of the product line.

Elevate and grow the marketplace: Return to wholesale partners: Nike re-enters Amazon to sell there directly, and started to rebuild connections with wholesale partners, especially in China.

Win on the ground: Celebrate local athletes and expand efforts to build grassroot communities like Nike running club.

We still think that Nike can successfully rebuild their brand value, although the company went off-course for a few years with the wrong focus. At the end of the day, Nike is still Nike. Nevertheless, Nike’s inventories are still high at US$7.5 billion (28 Feb 2025). This might imply that the worst is yet to come.

Nike’s PE ratio (red line) is near 8-year low

The current market cap of Nike is US$94 billion (11 June 2025) and the last 4 quarters of net income is US$4.5 billion. This implies a PE ratio of 21x, which is near to its 8-year low of 19x. The current valuation is definitely not cheap, but we have added it into our watchlist., because the Win Now strategy definitely looks promising.

— — — —

ON Shoe and HOKA

The downfall of Nike, gave opportunity to ON, HOKA and ASICS to rise.

HOKA vs ON: Both have very distinct design language

When Guan 🍉 was in the US, it’s clear that ON is gaining traction there, with 20% of people on the street wearing ON shoe. Occasionally, you will see people wearing HOKA shoes, around 5% of the time. Both these brands have very distinctive design, so it’s easy to notice them.

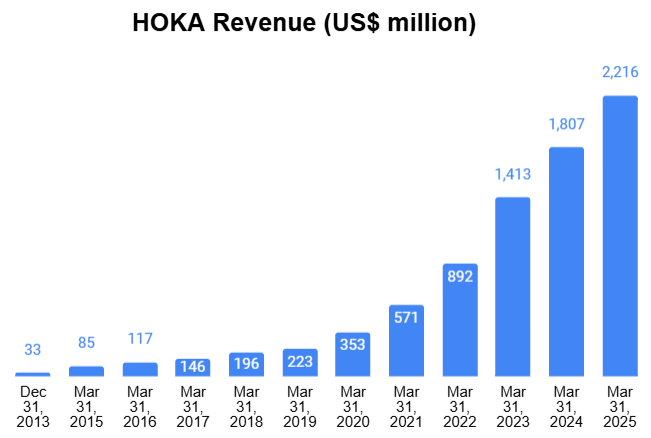

HOKA revenue since acquisition in 2012

HOKA is particularly interesting because of the lower base it is growing from, and great review it has among the hiker and runner communities. HOKA sales is more than amazing, with US$2.2 billion sales in Mar 2025 (42% CAGR for the past 12 years).

HOKA is part of Decker Outdoors Ltd, a listed company in the US. The crazy thing is Decker acquired HOKA in 2012, with US$1.1 million. Today, HOKA generates US$2.2 billion sales for Decker.

We will cover Decker in depth, in our next exclusive content.

If you have any questions, feel free to ask in the comment section, or in the group chat and we will try our best to address them.

Stay safe and stay strong investing.

Cheers,

Guan🍉 and HY🦭

DoitDuit

— — — —

So, this is adulting is intended for a single recipient only, but occasional forwarding is totally fine! If you would like to order multiple subscriptions for your team with a group discount (minimum 5), please contact us directly.

Thanks for being a subscriber, and have a great day!

Reply