- So, this is adulting by DoitDuit

- Posts

- Yinson 2025 Annual General Meeting Notes

Yinson 2025 Annual General Meeting Notes

Yinson on track for all operating segments to be EBITDA positive by 2027 amid transition from EPCIC to operational assets: Stronger operating cash flow; Refinancing of projects, Growing strong in renewables, Increasing shareholder returns.

Disclaimer: This article is in no way financial advice, nor solicitation to buy or sell shares in this company. It is purely for educational purposes only. You are highly recommended to conduct all necessary due diligence and make your own informed decisions before making any financial decisions. The writer already owns shares in this company and may at any point in time increase or reduce their position without prior notice. Do not try to copy trade!

Today, I attended Yinson’s AGM to see how things are developing for the company. Here are my summarised notes from the nearly 3 hour session.

For a brief understanding of Yinson, please refer to my previous coverage on Yinson:

Presentation by the Group CEO, Lim CY:

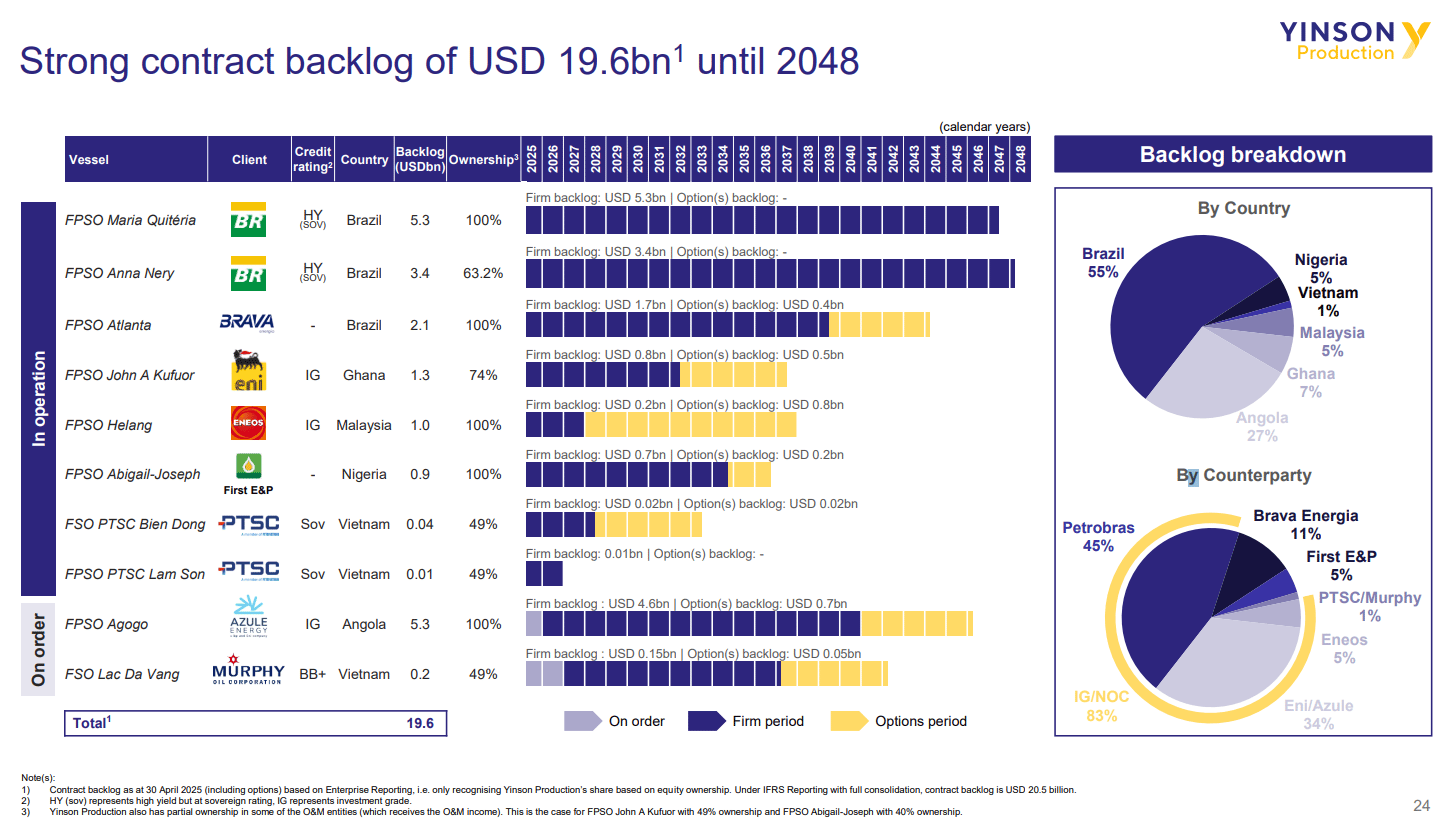

FPSO Agogo is estimated to achieve first oil within the next 2 months.

The management is looking to refinance more projects on the bond market, mainly to get back capital and de-risk themselves. The bonds will be tied to the operational asset and be non-recourse to the group.

FPSO Maria Quiteria Bond is a highly unusual bond for the bond markets. Nearly 20-year maturity, non-recourse, no corporate guarantee, unsecured bond, with sizing of almost USD1.2 bil yet oversubscribed by 4x.

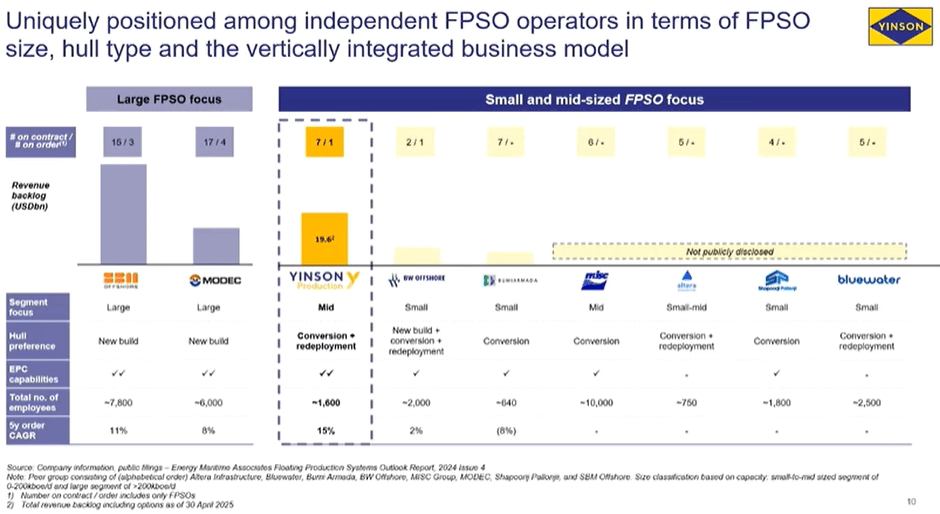

Analysts often say that there are 9 major FPSO players in the world, but in Yinson’s view there are mainly only 3 major ones including themselves; the others have very small FPSO business. Within this niche, Yinson focuses on conversion, redeployment, and operation vs the other competitors who prefer to take on new build projects.

Of the big three in the industry, Yinson also focuses on mid-sized FPSO vs the other two who focus on large scale FPSO projects.

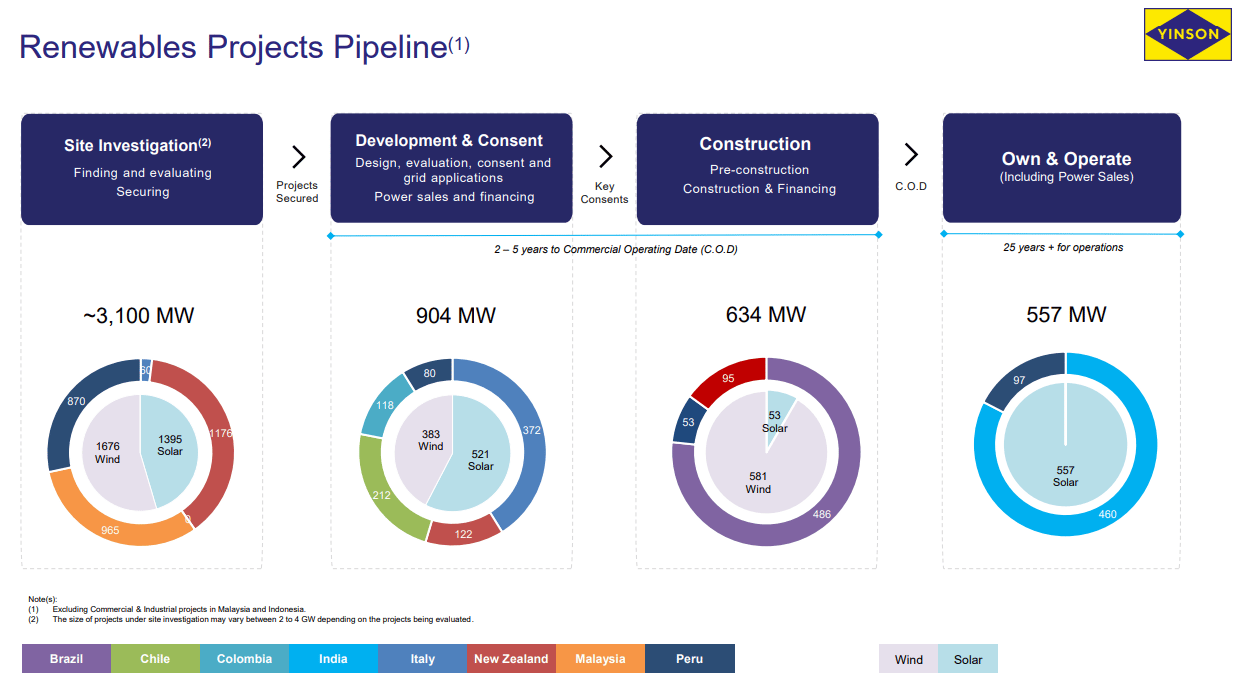

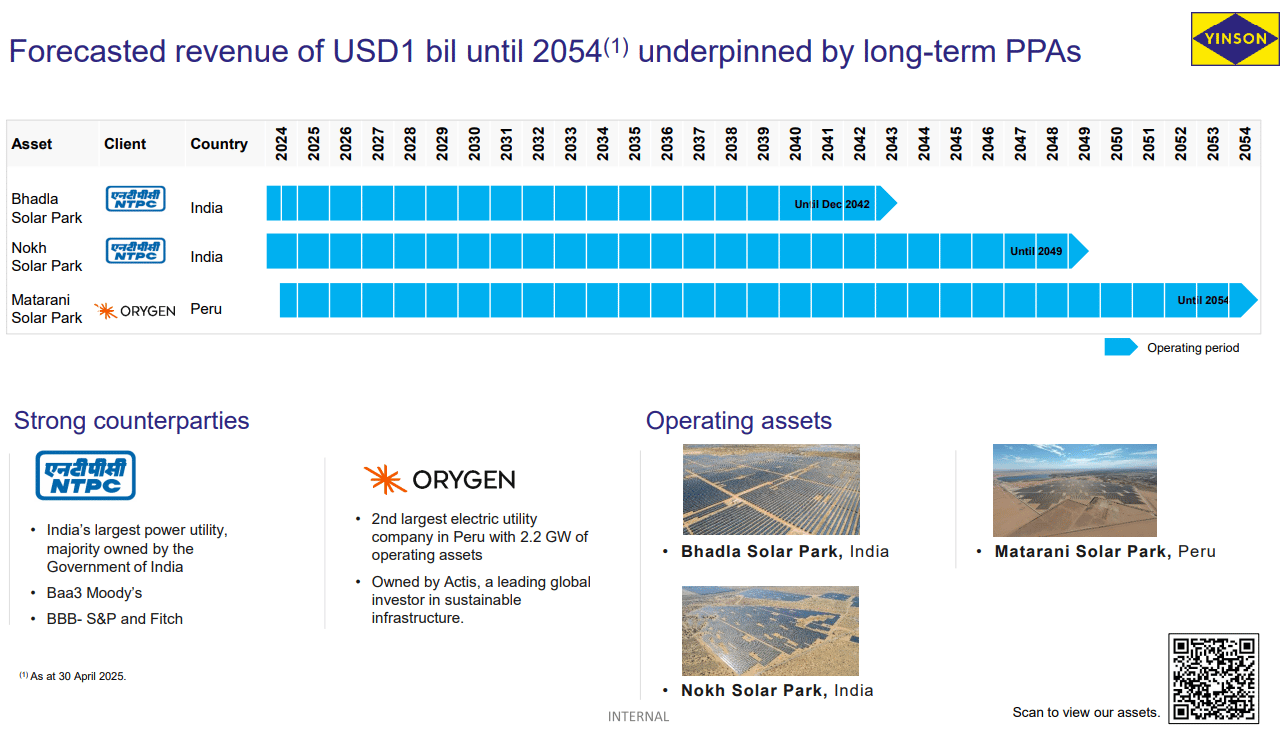

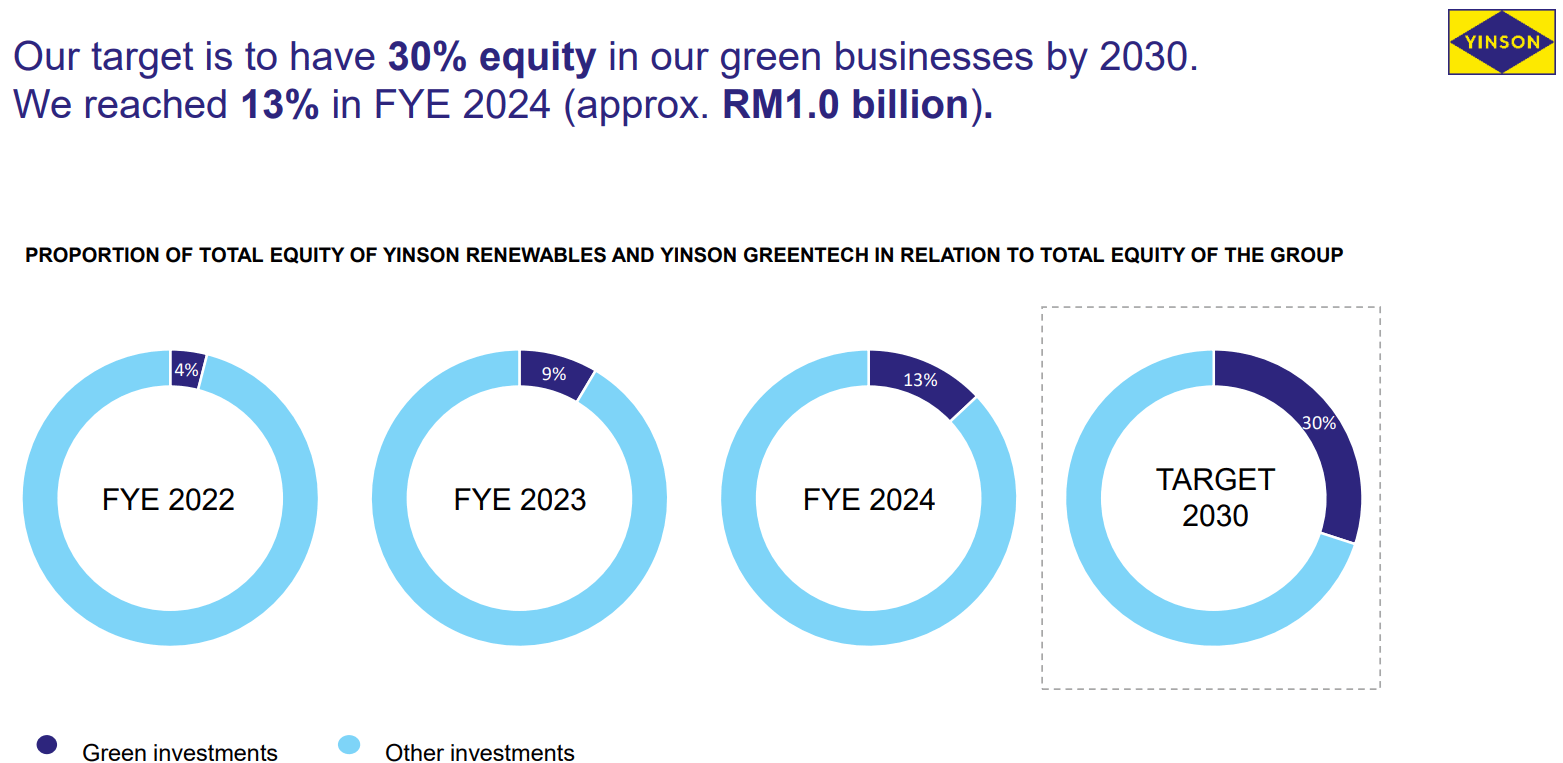

Yinson Renewables currently has 557MW of solar assets in operation after their Matarani Solar Project in Peru just recently got energized. They also have an additional 634MW of renewable energy assets under construction, in Brazil, New Zealand, and Peru, which are expected to come online in the coming years.

Yinson highlighted that renewable energy asset ownership, like their FPSO business, is a capex heavy business that takes time to build up. While the financial numbers for the segment may not look attractive now especially when compared with their FPSO business, it will continue to grow and be backed by long term power purchase agreements.

Yinson is not just looking to grow revenue at all cost, but they place heavy emphasis on sustainable returns on their investments. The projects have to make financial sense and also meet their risk criteria before they embark on it.

Yinson mentions that the average valuations in the renewable energy industry has come down from the peak and have become more reasonable. Potentially, Yinson may be looking at some M&A in this sector, although there is nothing concrete yet.

Yinson Green Tech is focusing on turning around into EBITDA positive by 2026-2027. Yinson’s focus is to make all operating segments EBITDA positive before 2027.

Be a paid subscriber to read the rest of the article!

You can unlock paid subscriber-only contents & perks such as exclusive group chat and offline community meetups when you join the Community Subscription.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Access to DoitDuit portfolio

- • Offline community meetup every month

- • 1-2 exclusive content sent to you via email every week

- • Groupchat exclusive for paid subscribers on Telegram

Reply