- So, this is adulting by DoitDuit

- Posts

- Riding the Infrastructure Boom in Sarawak: Finding the potential winner

Riding the Infrastructure Boom in Sarawak: Finding the potential winner

An overview of players in the space and found a small cap speculative play for exposure to the infrastructure developments in Sarawak

Disclaimer: This article is in no way financial advice, nor solicitation to buy or sell shares in this company. It is purely for educational purposes only. You are highly recommended to conduct all necessary due diligence and make your own informed decisions before making any financial decisions. The writer does not own shares in this company and may at any point in time increase or reduce their position without prior notice. Do not try to copy trade without understanding the risks!

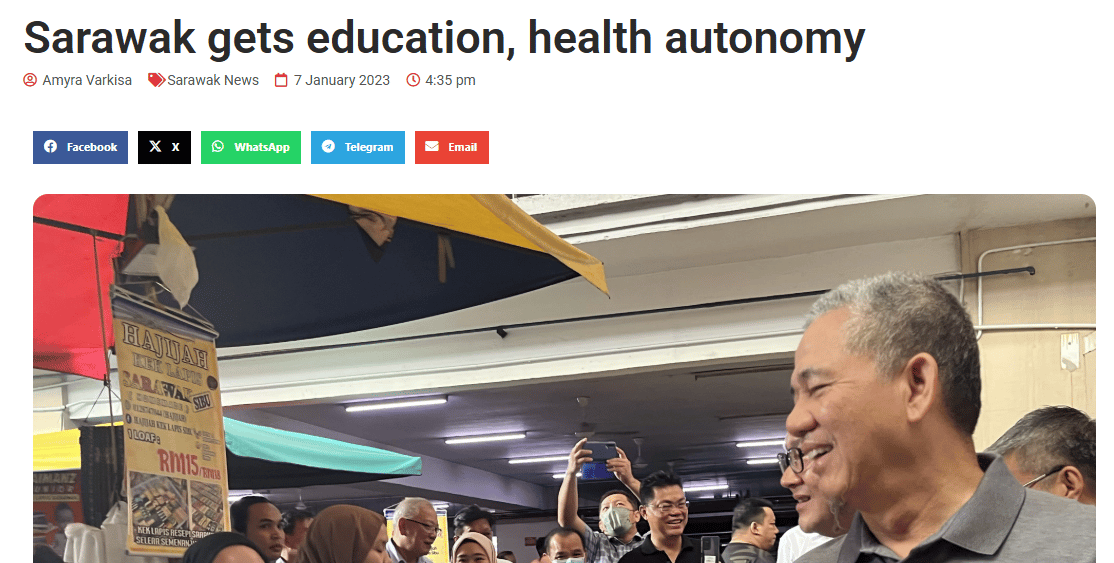

Sarawak is seeing major fund inflows into the state for development, from both the Federal Government as well as from within the state itself. For the most part, the budget focuses on construction and infrastructure.

Sarawak places significant emphasis on empowering local Sarawakian companies for state projects, with only the very large-scale projects typically being awarded to Peninsular Malaysian or International companies on a joint venture basis.

Therefore, as an investor, how do we get access to a slice of this pie? The most logical answer would be to invest in companies operating in this space with a high likelihood or chance of securing works under the development scope in the state.

As such, I am looking into companies that are headquartered in Sarawak or have substantial interest in Sarawak that operates within the construction or infrastructure sector.

Record high allocations for Sarawak State developments

Excerpt from Belanjawan 2025

Sarawak gets the 2nd highest federal budget allocation of RM5.9 bil in 2025. Other than the federal budget, the Sarawak state itself has allocated a RM15.8 bil budget, of which RM10.9 bil is allocated for state development (highest in Sarawak’s history). From the RM10.9 billion, ~RM6.8 bil is allocated for rural development, including construction of roads, bridges, water and electrical infrastructure etc.

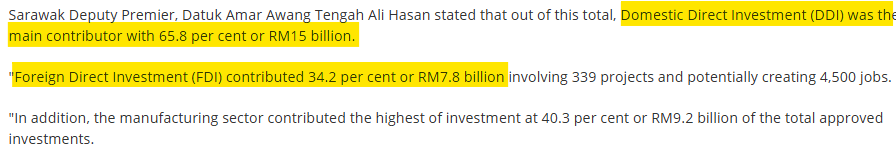

Non-Exhaustive List of Construction and Infra Projects and their Announced Allocations:

Please note that the above table is a non-exhaustive list:

Summary of various announcements by the state or federal governments;

Exact figures will not be known until the actual award; and

The numbers are not on a “per year” basis, allocations are adjusted every year as per the Budget announcements.

However, it is reasonable to assume at least a substantial portion of the allocated budgets materialise into actual projects in the near future.

Federal Government Granted Autonomy to Sarawak in Education and Healthcare Matters

Historically, all matters relating to education and healthcare fell under the purview of the federal government. However, since 2023-2024, the federal government had, in principle, agreed to grant Sarawak full autonomy over its own state’s education and healthcare matters. This is because Sarawak has been complaining that the lack and delay of approved funding has impacted the progress of improving Sarawak public infrastructure.

This is a significant change in policy, as there will be fewer bureaucratic barriers in implementing local projects. Coupled with Sarawak’s record high development budget, I would expect substantial expedited contract awards within the state to happen in the near term once the policies have been finalised.

Listed Companies who operate in Sarawak and their brief business outline

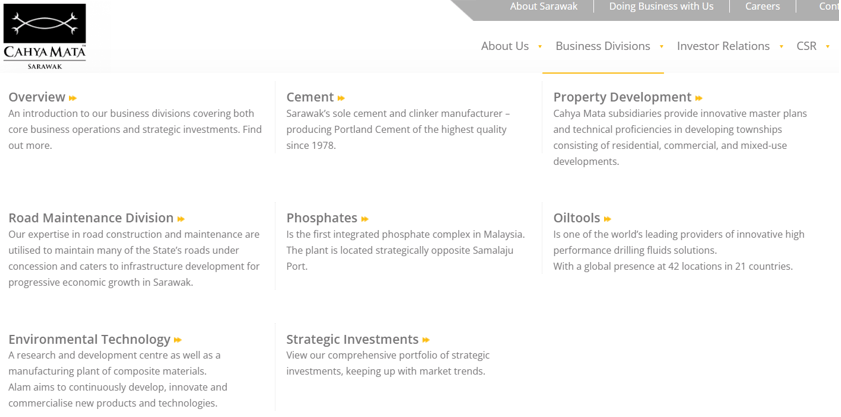

1. Cahya Mata Sarawak Berhad (CMSB)

The biggest construction-conglomerate company in Sarawak, with monopoly over many crucial supply chains including the production of cement in the state. The company is rife with corporate governance issues, having had multiple scandals in the recent few years, as well as shareholder arguments between the owning families ever since Abdul Taib passed away.

Nevertheless, this company will likely be involved, in some way or another, in almost all projects in the state. There are rumours that the Sarawak state government intends to intervene in the ownership of this company due to the strategic assets the company has, however there is nothing concrete at this juncture. The book value per share is about RM3.19.

_______

2. KKB Engineering (KKB)

A steel pipe and liquified petroleum gas cylinder manufacturer in Sarawak and 20% owned by CMSB. KKB manufactures the pipes used by the O&G industry as well as water utilities, among others. They are also involved in engineering works including steel fabrication for highways, civil construction, O&G, and galvanizing works.

It’s worth noting that this company has about RM200 mil net cash, and has been consistently paying out dividends every year. Currently, the company has about RM250 mil orderbook and RM590 mil tenderbook mainly for O&G engineering works. Previously, they have been involved in water supply projects in Sarawak.

_______

3. Ibraco Holdings (IBRACO)

Ibraco is mainly a property development and residential construction company. However, in recent years their construction arm had been securing infrastructure related works, including the Sarawak Second Trunk Road, Batang-Samarahan Bridge, Kuching Urban Transportation System project, Package NR4 of the Sarawak Water Supply Grid project etc.

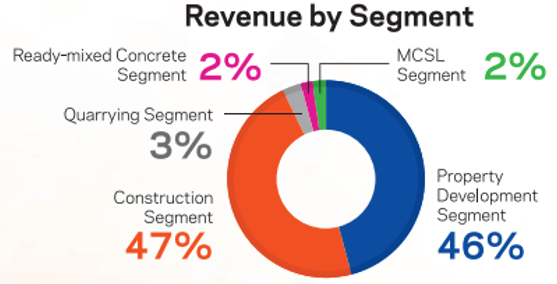

This has caused their revenue and profits to chart a steady growth path, which have also led to increasing dividend payouts in tandem. Other segments that are small relative to the overall business include quarrying, ready-mixed concrete, Mild Steel Cement pipes, hospital etc.

Be a paid subscriber to read the rest of the article!

You can unlock paid subscriber-only contents & perks such as exclusive group chat and offline community meetups when you join the Community Subscription.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Access to DoitDuit portfolio

- • Offline community meetup every month

- • 1-2 exclusive content sent to you via email every week

- • Groupchat exclusive for paid subscribers on Telegram

Reply