- So, this is adulting by DoitDuit

- Posts

- RCE Capital -40% in 1 year: Opportunity or Trap?

RCE Capital -40% in 1 year: Opportunity or Trap?

Deep dive into the business model of RCE Capital, what is causing the share price to crash and the future outlook for the company

Disclaimer: This article is in no way financial advice, nor solicitation to buy or sell shares in this company. It is purely for educational purposes only. You are highly recommended to conduct all necessary due diligence and make your own informed decisions before making any financial decisions. The writer do not own shares in this company and may at any point in time increase or reduce their position without prior notice. Do not try to copy trade without understanding the risks!

RCE Capital: Ah Long for civil servants -40% in 1 year

Share price performance of RCE Capital

For the past 1 year, RCE Capital Bhd share price dropped -40% from RM1.77 (52W high) on 11 Nov 2024, to RM1.05 (52W low) on 26 June 2025, and currently hovering around RM1.07 as at 14 June 2025 (-39% from peak). This is an interesting development given the business model of RCE that is considered relatively stable.

Business model of RCE Capital

RCE Capital is a loan company that give loans specifically to civil servants only. They partner with foundations (yayasan) and cooperation (koperasi) to disburse personal loans to civil servants, mainly via:

Yayasan Ihsan Rakyat (YIR); and

Yayasan Dewan Perniagaan Melayu Perlis Berhad (YYP).

Why RCE needs to partner with YIR and YYP is because foundations and cooperation in Malaysia has the power/license to directly deduct salary from civil servants via ANGKASA, or Accountant General Malaysia (AG). In a way, civil servants are forced to pay loan first before receiving their salary. This system streamlined the loan collection process and significantly reduce the risk of loan default.

Business model of RCE Capital

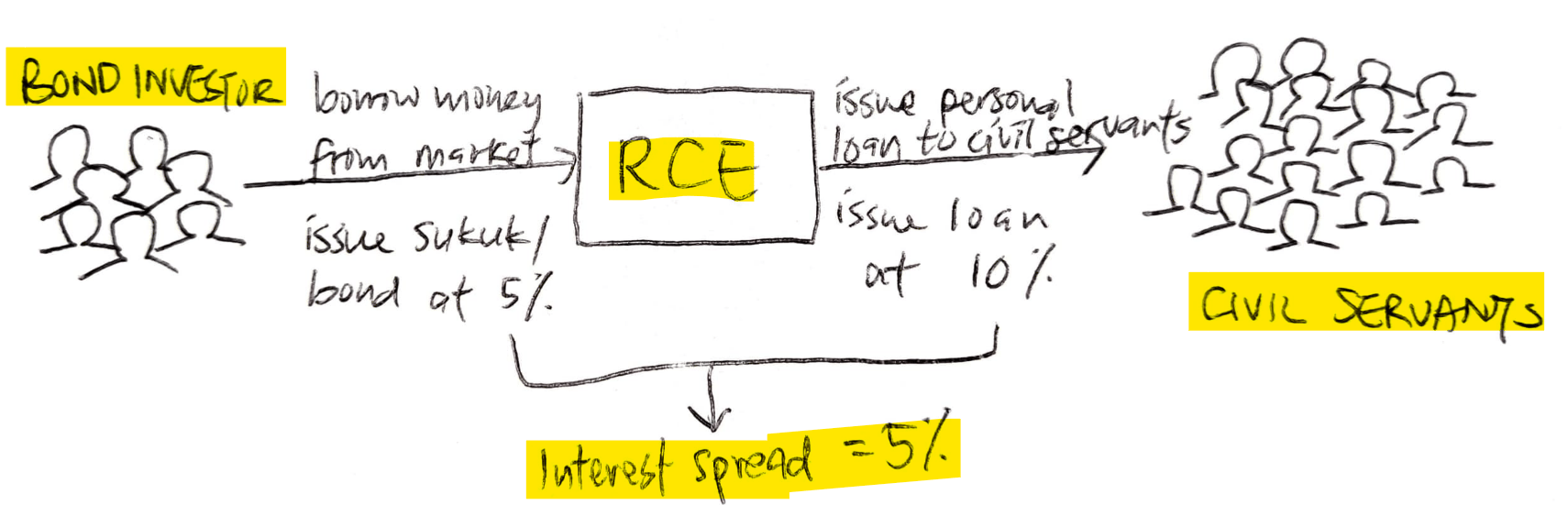

The business model for RCE is very simple:

RCE will borrow money from the market via sukuk/bond issuance at x%;

RCE will then issue personal loans to civil servants at y%;

y% - x% = the spread or margin that RCE will earn, a.k.a. interest spread.

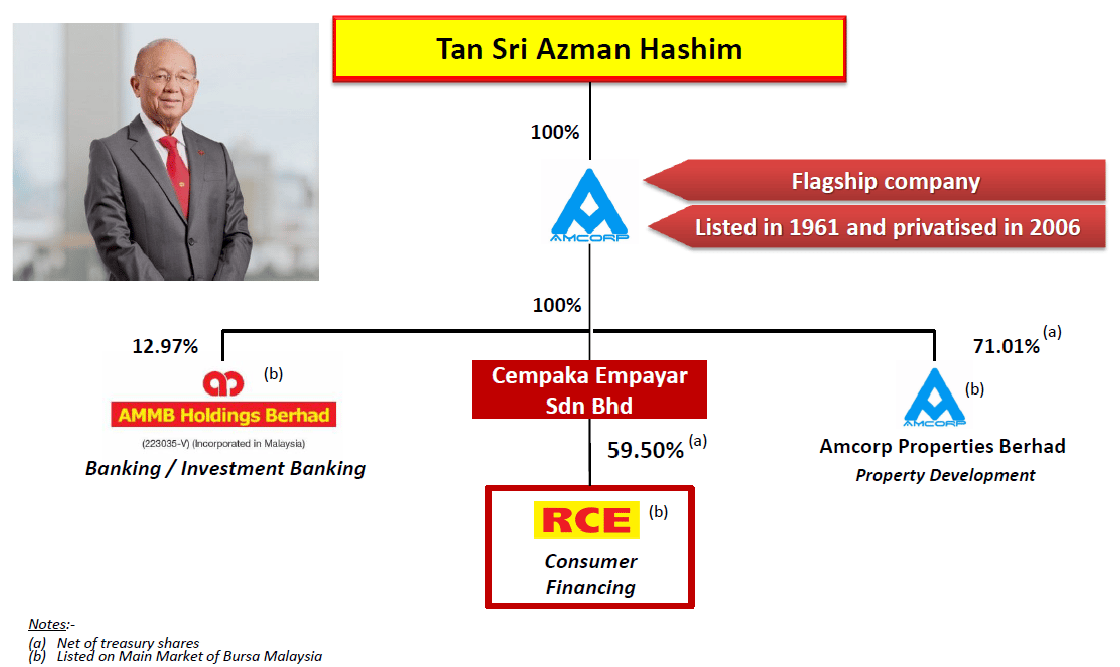

As of 2020, exact shareholding may differ but the shareholding structure is similar

RCE is a subsidiary of Amcorp Group Berhad, the biggest shareholder of Ambank. The ultimate biggest shareholder of RCE Capital and Ambank is Tan Sri Azman Hashim.

“The number of civil servants applying for personal loans has increased by 10 per cent, or 70,000 people, ahead of this year's Hari Raya Aidilfitri. In non-festive months, about 50,000 civil servants take out personal loans…

Angkasa manages over 800,000 civil servants in Malaysia who have taken loans through the salary deduction system, with total salary deductions reaching between RM1.2 billion and RM1.5 billion per month.”

Malaysians love personal loans, civil servants with low salary loves personal loans even more, compounded with these factors:

Direct salary deduction system

Low possibility of civil servants getting fired

Stable salary increment for civil servants

Bloated civil servants system where Malaysia has one of the highest “civil servants % to population” in the world

Because of these reasons, many companies focus their efforts on issuing personal loans to civil servants. Not to mention that the civil servant personal loan market is a growing market, predictable and most importantly, low risk. RCE Capital is one of the company riding this wave.

Malaysia's bureaucracy is one of the biggest in the world, with ~1.5 million civil servants to a population of 34 million, a ratio of 4.3%.

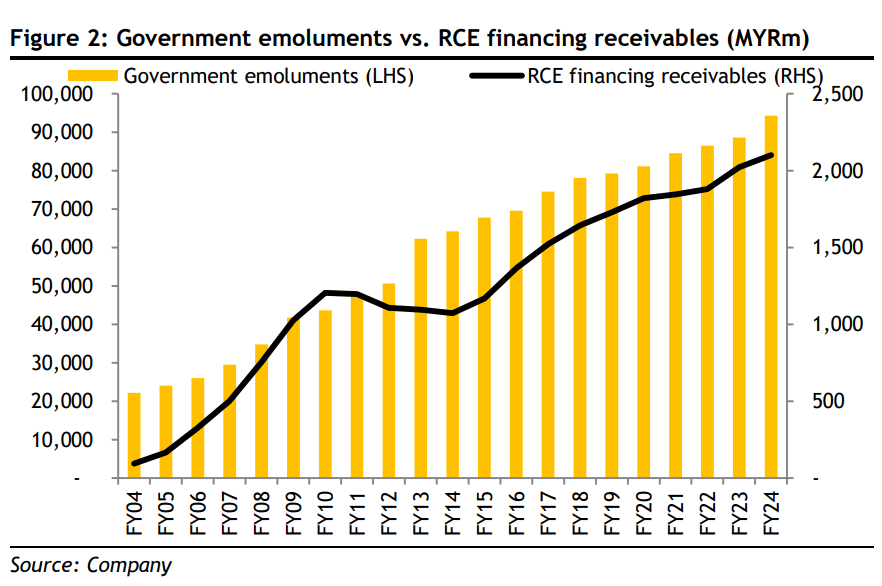

RCE Capital personal loan book also grows alongside government spending on civil servants’ salary. The higher the civil servants’ salary, the more personal loans they can take, the higher RCE’s loan book is.

RCE Capital’s strong growth from 2020 to 2024

Share price performance of RCE Capital

RCE had a super strong uptrend rally from 2020 to 2024, mainly because of few reasons:

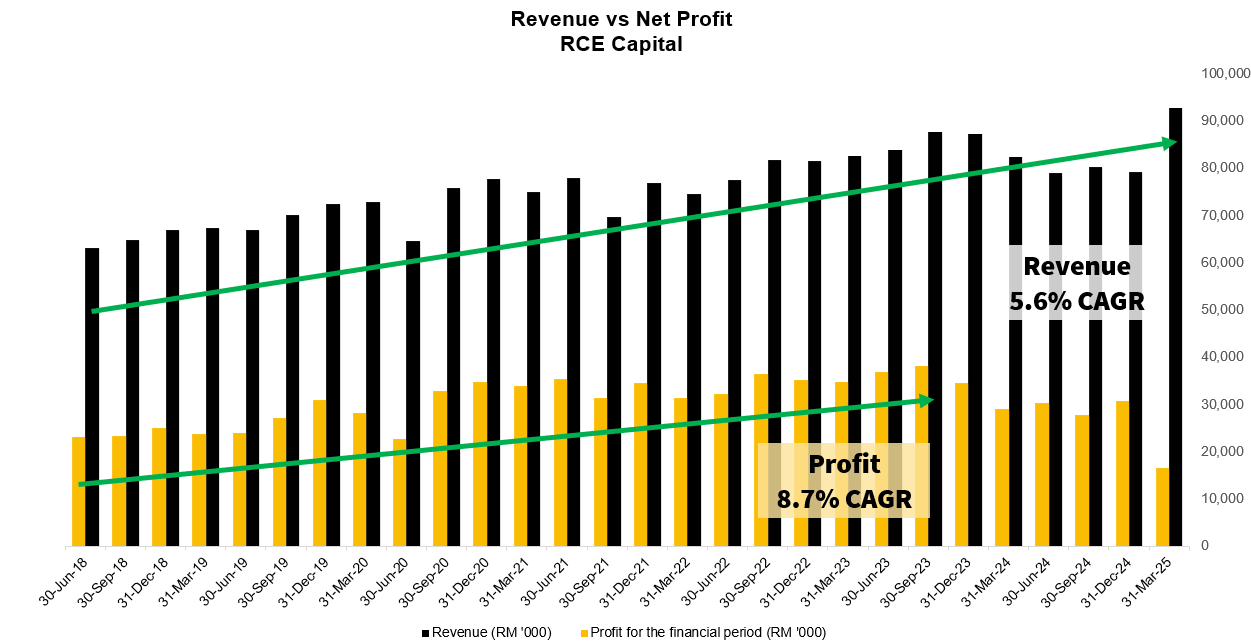

1. Strong growth in revenue and profit

Historical quarterly revenue and profit of RCE Capital

RCE’s revenue grew 5.6% compounded annual growth rate (CAGR) from 2018 to Mar 2025; while profit grew 8.7% CAGR from 2018 to Sep 2023. The growth was mainly because of:

i. Higher income from refinancing due to OPR cut

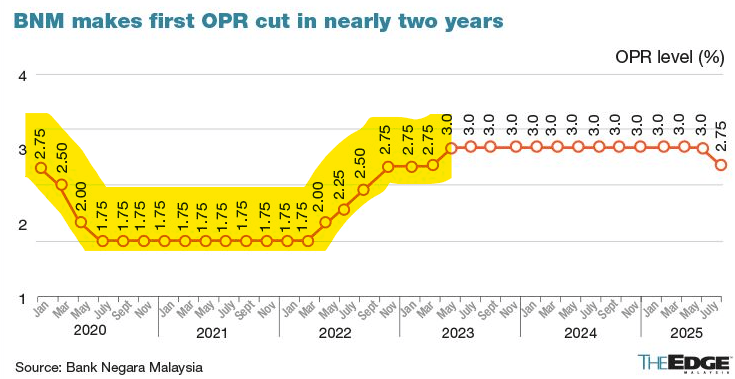

Historical OPR rate from 2020 to 2025

During Covid times, Bank Negara Malaysia cut OPR rate to 1.75%, a record low in Malaysia history. Many people thought that when interest rate is low, companies that rely on loans like banks and money lending business will decline, because the loans they give out has lower interest rate. This is a wrong assessment of the business.

When interest rate is low, especially when it’s very low like during the Covid 1.75% period, there will be many refinancing applications. People will take the lower rate loan, to early settle their existing higher rate loan and continue to pay the new loan with a lower interest rate.

It’s the same for RCE Capital, whereby the low interest rate environment pushed their refinancing loan application to historical high, resulting in higher revenue and profit.

ii. Civil servant salary increment

The low OPR rate environment coincides with civil servant salary increment in 2022, because of general election. Civil servants’ usual salary increment is 3% a year. Government only allow civil servants to borrow up to 60% of their salary (60% debt service ratio). When civil servants salary increase, they will have more room in their salary to take more loans.

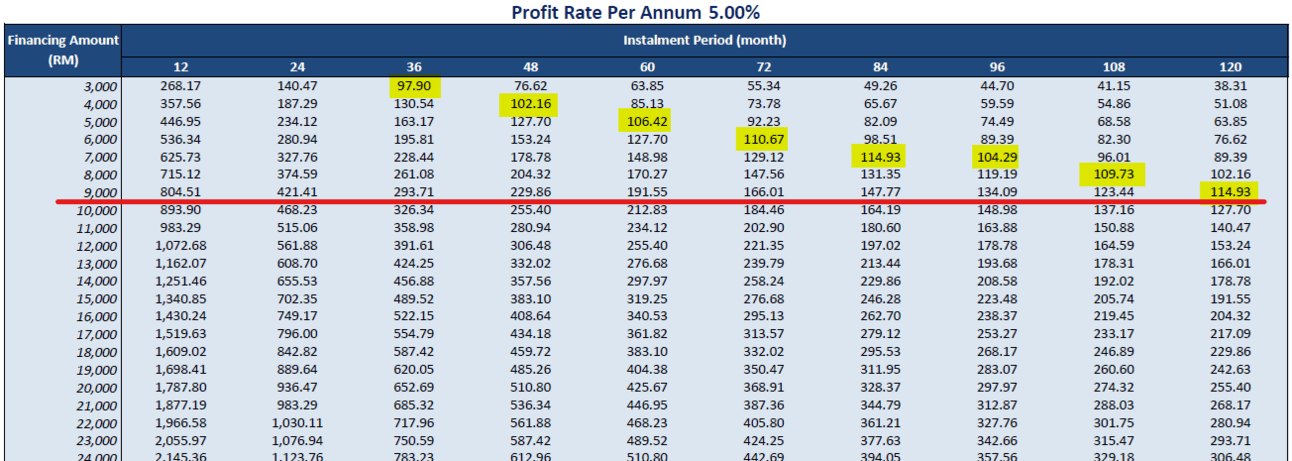

Payment schedule for 5% interest rate loan

For example, if the civil servant salary is RM3,000, they get RM100 salary increment in 2022, on top of the 3% annual salary increment. Their salary will become RM3,190, giving them RM114 more space to take another loan. RM114 monthly loan instalment is equivalent to a new RM9,000 10Y 5% personal loan.

Note: The 2022 average and median salary of Putrajaya state is RM13,473 and RM10,056 respectively.

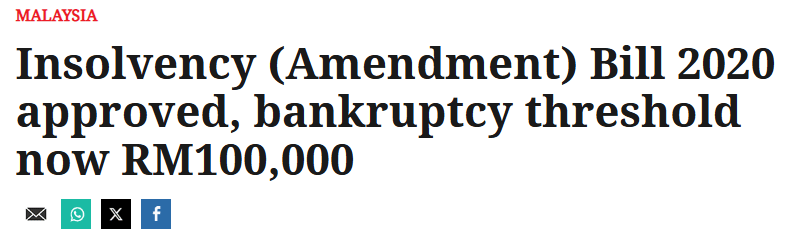

iii. Revision of bankruptcy threshold

In 2020, our government revised the bankruptcy threshold from RM50,000 to RM100,000 because there are too many bankruptcy during Covid period. In 2023, government introduced “Second Chance Policy” to release many people in bankruptcy as a free man.

This has opened up the “total addressable market” for RCE Capital because many people in bankruptcy can now take loans again. Of course you might ask, “People with bankruptcy background is too high risk to give them loans”.

Yes, but in the loan business, all types of risk has a price. If you are a high risk loan applicant, what loan companies need to do is to offer you loan with a higher interest rate with lower payout to cover up for the risk they take.

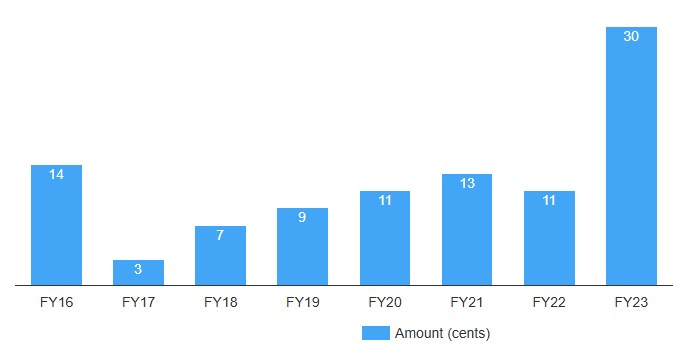

iv. Increasing dividend + Special dividend + 2 times bonus issue in 3 years

On top of the improving business, RCE management was also actively pushing up its share price with “shareholder-friendly” corporate actions:

Historical increasing dividend + Special dividend in 2023

History of increasing dividend + RM0.18 special dividend - The dividend yield for FY2023 alone was 17%.

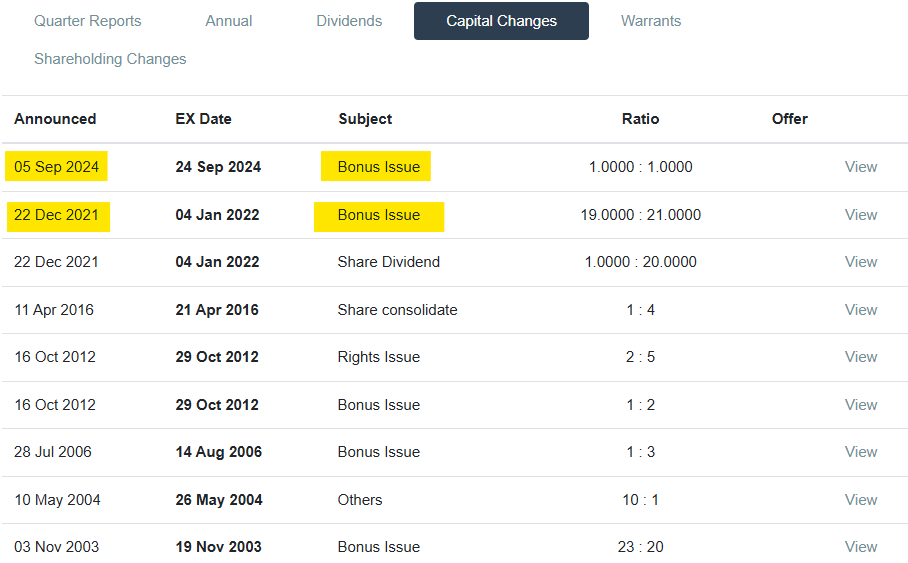

Corporate Actions undertaken by RCE Capital

2 times of bonus issue, one in 2022 and another one in 2024 - Within 3 years, RCE announced 2 times bonus issue to split the company outstanding shares into smaller parts. Although it is said that bonus issue do not increase the value of the company, but in Malaysia, bonus issue is generally taken as a shareholder friendly move because the share price is more affordable for retail investor.

Share price performance of RCE Capital for the past 1 year

Reply