- So, this is adulting by DoitDuit

- Posts

- Nvidia, Google and AI Bubble: What People Dont Understand

Nvidia, Google and AI Bubble: What People Dont Understand

Nvidia just posted US$31.9 billion profit—so why did the stock crash 13%? This article discuss the impact of Google owning TPU AI chip, Gemini 3 breakthrough on Nvidia.

This is a difficult piece to write, because on one hand I know the market is wrong, but on the other hand, it is impossible to predict short-term stock price movement.

Nvidia share price from 17 Nov to 25 Nov 2025

Nvidia’s share price shot up 5.4% right after earnings result released, then crashed 7.6% when the market opened the next day. In total, Nvidia crashed 13% since releasing its latest earnings result.

Nvidia’s historical quarterly revenue and profit

When you look at Nvidia’s Q32025 result, it is amazing. US$31.9 billion quarterly net profit is almost comparable to the world’s most profitable business, Google that achieved US$35 billion quarterly net profit.

Few reasons why Nvidia share price crashed despite the strong result, and why the market might be wrong:

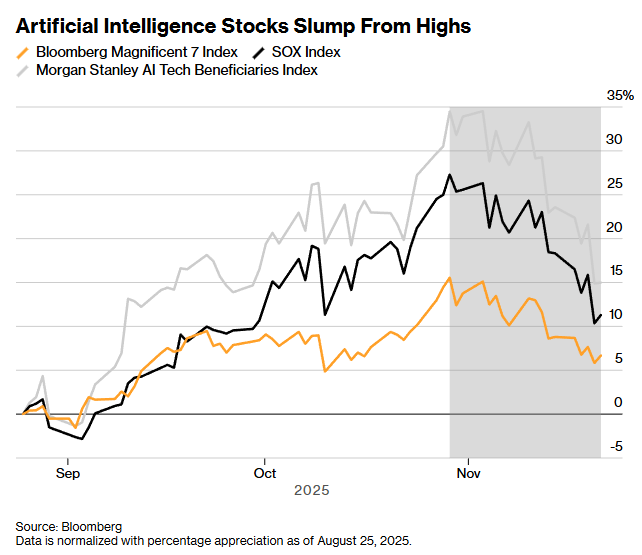

1. The market is extremely concerned about the AI bubble

Everyone knows that companies are spending a lot on CAPEX to expand into AI, so they need to be convinced by looking at Nvidia’s number. Nvidia’s great result comfort the market at first, then many investors start to take their profit off the table, crashing the market.

Peter Thiel and Masayoshi Son exited Nvidia

Few big investors, include Peter Thiel from Founders Fund and Masayoshi Son from Softbank had recently exited all their Nvidia position, also made the market panic. The balance of skepticism by investors and optimism by Big Tech towards AI is the reason why we might not be in a bubble yet.

2. The bond market remains rational despite the AI boom

Bond market is growing so fast, so big

The first 2 years of AI expansion (2023/24) is all funded by Big Tech using cashflow. Starting from 2025, when Oracle entered the scene with huge debt, it has triggered a land grab towards AI. Big Tech also starts to take on more debt to fund their AI expansion, hence we mentioned in our The Ingredients for Stock Bubble is All Ready article that the expansion is starting to look bubble-ly.

Bonds issued by Big Tech companies

But this is by no means the AI bubble is popping now, it just means the AI bubble just started. The bond market, which is the most risk-averse investors are still very rational even when lending money for AI expansion. Bond investors are asking for higher return (yield) to cover the risk in AI expansion.

Be a paid subscriber to read the rest of the article!

You can unlock paid subscriber-only contents & perks such as exclusive group chat and offline community meetups when you join the Community Subscription.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Access to DoitDuit portfolio

- • Offline community meetup every month

- • 1-2 exclusive content sent to you via email every week

- • Groupchat exclusive for paid subscribers on Telegram

Reply