- So, this is adulting by DoitDuit

- Posts

- Malaysia Economy: 2026 and Beyond

Malaysia Economy: 2026 and Beyond

December 2025 Community Meetup; Understanding Malaysia's structural weakness in AI revolution, and investment opportunities in budget retail, lending, and plantations.

Summary:

(1) Structural Stagnation in Malaysia: Malaysia is trapped in a low-value economy due to historical protectionism, reliance on natural resources and lacked of talent with innovation capability and risk-taking spirit.

(2) Investment Strategies: Opportunities exist in sectors that profit from financial tightness, i.e. budget retail, lenders, pawnbrokers; Visit Malaysia 2026 tourism theme; and Malaysia's only global competitive advantage in palm oil plantations.

Dec 2025 Community Meetup:

With so much market uncertainty going into 2026, we will share our thoughts on the market with you. We will adopt a more Q&A, conversational style for this round's meetup.

RSVP: https://forms.gle/MZCSvNcaFRJcCedB6

What to expect:

1️⃣ What we think about investing in 2026 (45 min)

2️⃣ Q&A with HY, Guan and Ren (45 min)

Details

Date: 20 December 2025 (Saturday)

Time: 10am - 12pm

Ticket price (including light bites): Free for Paid Subscriber; RM30 for everyone

Location: Co-labs @ Starling

I am reading the biography of Morris Chang (the founder of TSMC, the world biggest semiconductor manufacturing company), and this quote (in Chinese) caught my eye:

”今日的美國經濟轉緩,只是週期循環的一個現象,並不代表知識經濟的消滅。事實上,知識經濟現在尚在起步階段,但會是先進國家的未來經濟模式。從前經濟競爭力的要素是:自然資源、人才、資本和技術。

隨著科技的進步,許多自然資源可被人工產品代替。隨著經濟全球化,資本自由流通,已不再為國家競爭力要素。技術的流通度也大為增加,但仍不失為國家競爭力的一要素。教育普及化使得「人才」有了新的意義。光是受過教育的人才現在已不夠,更重要的是有創新能力和冒險進取精神的人才。“

Translating into English and in simple words, Morris Chang was saying (in 2001) that in the old economy model, a country’s competitive advantage were based on 4 factors:

Natural Resources;

Educated Human Resources;

Capital; and

Technology.

However, technological advancement and globalisation have significantly reduce the importance of capital and natural resources, i.e. synthetic material can replace natural resources and capital is abundant.

Hence in today’s economy, a country’s competitive advantage are heavily reliant on 2 factors only: Innovation capability (Technology) and Risk-taking talent (Human Resources).

Sadly, Malaysia do not have both.

The problem with Malaysia economy

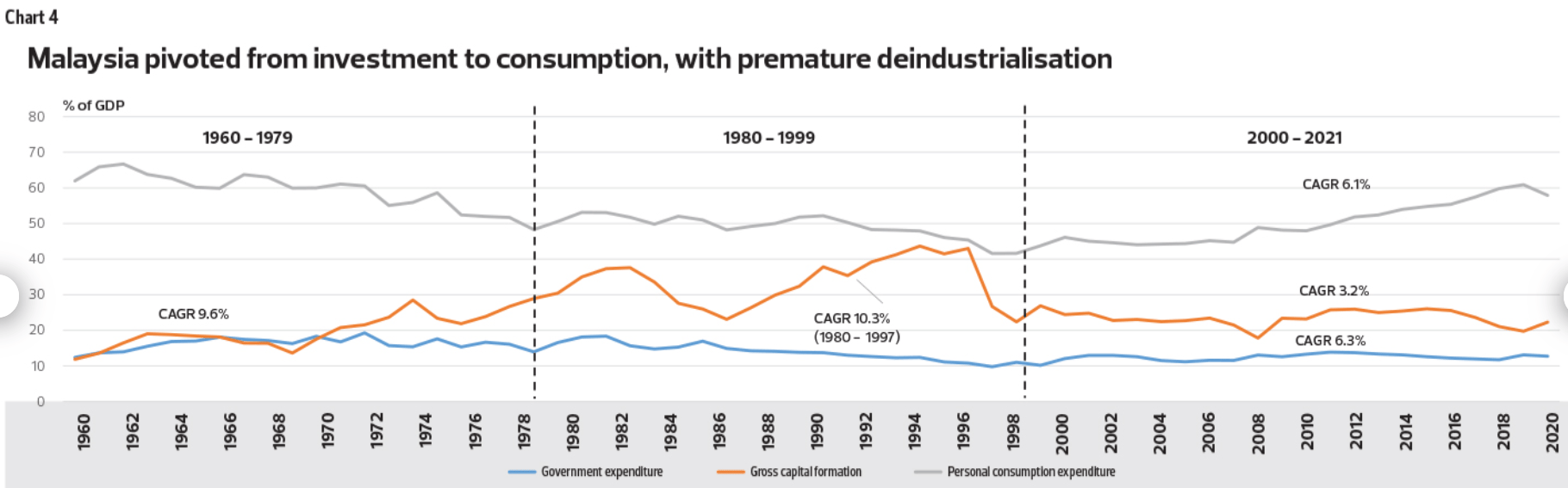

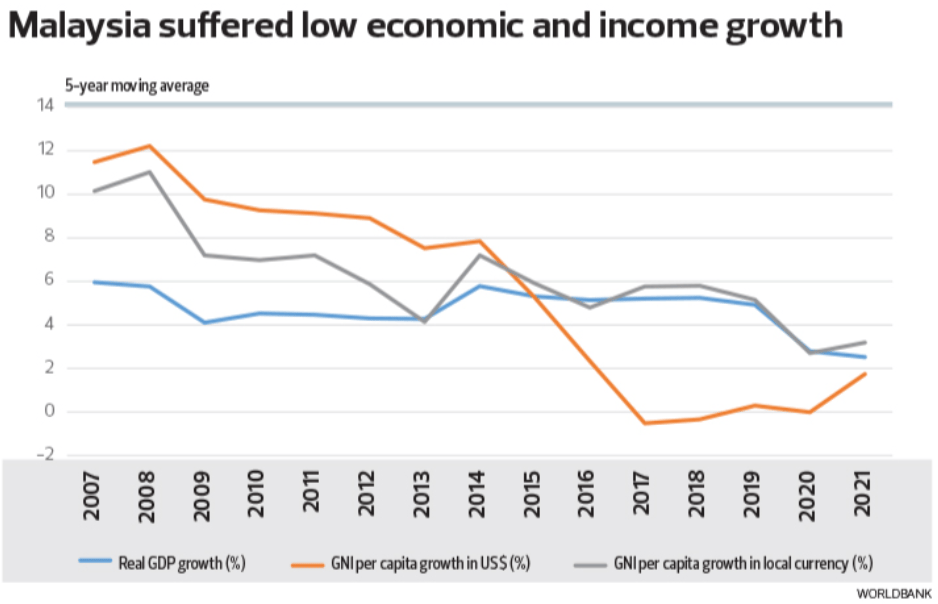

Historically, Malaysia has been heavily reliant on natural resources, from rubber and tin (1880-1960), to palm oil and petroleum (1960-today). In 1972, Intel entered Malaysia to maximise Malaysia’s cheap labour and Mahatir further doubled down on this cheap labour + industrialisation strategy (1985-1997).

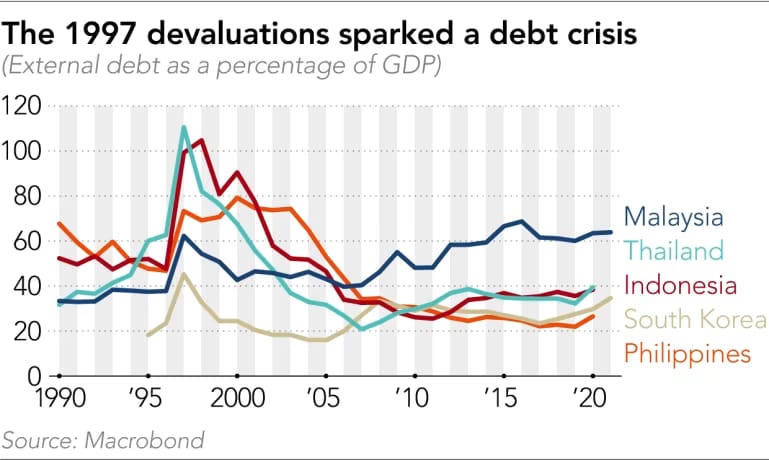

Then Asian Financial Crisis happened, Malaysia adopted a protectionist policy by ignoring IMF’s request for reform, implemented capital control to protect many local business from bankruptcy, and pegged RM to USD at RM3.80/USD.

Because of these protectionist policy, most Malaysia business dont need to innovate and compete in the global market. They succeed because of “connections”, creating many billionaires that can only compete in Malaysia’s 34 million population economy.

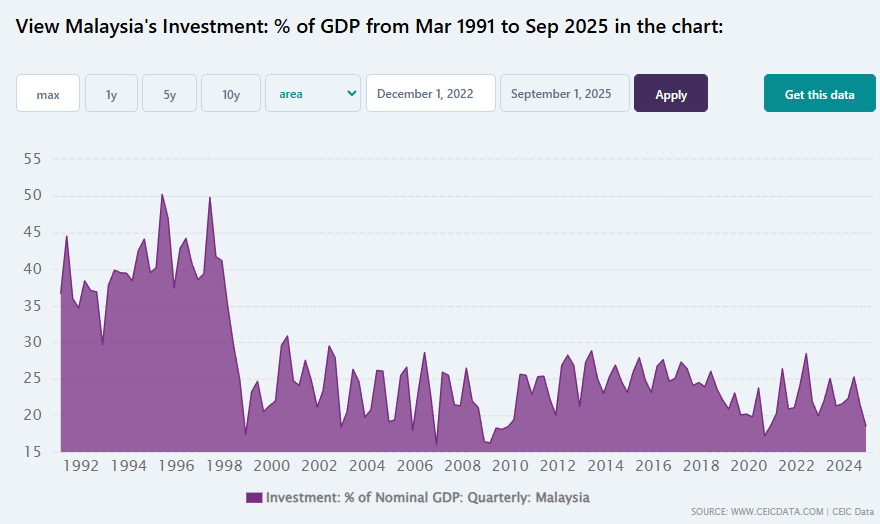

The spirit behind these protectionist policy and “connections” last until today. Private businesses stop investing for the future because capital and opportunities were only for the “selected few”.

Malaysia did recover after Asian Financial Crisis, mainly because of commodity boom boosting our economy that was heavily reliant on natural resources.

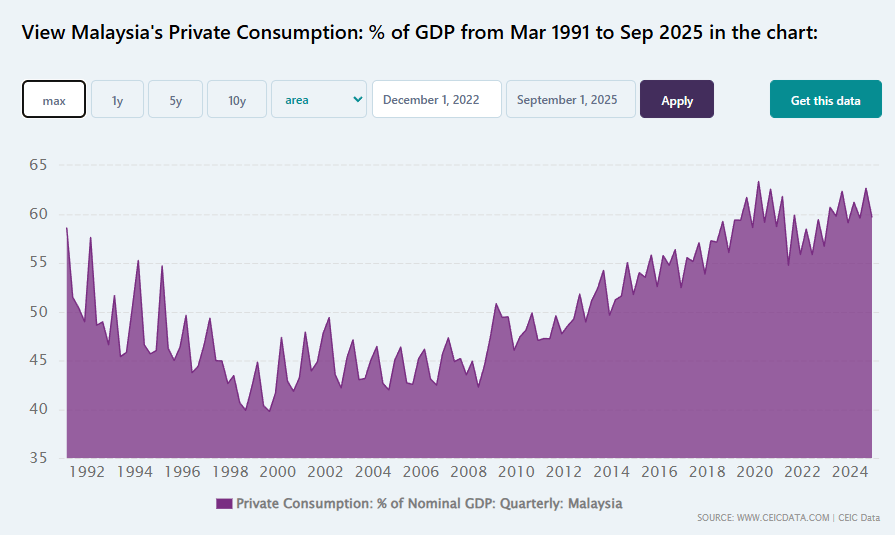

On top of that, our economy shifted from industrial to a service-based economy. Malaysians start to spend on services, real estate and consumer spending. Basically Malaysia are behaving like wealthy nations (spend on consumption) when we are not yet wealthy nations.

All of these historical context resulted in 3 structural weakness in Malaysia economy:

Private business not investing for the future → Low value chain business

Malaysia stuck in low value chain business → Lower income growth

Low income growth → Talent loss to high-income countries

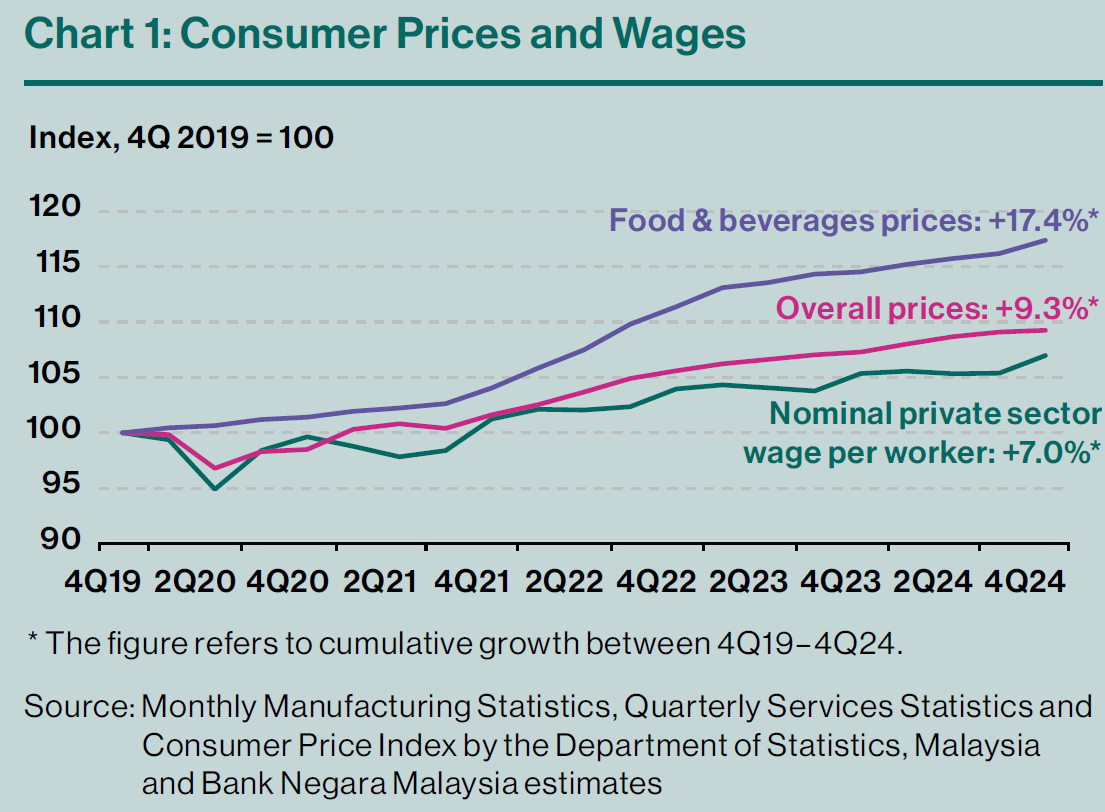

Since Covid, inflation has been growing faster than income growth, driving up cost of living and Malaysians start to feel financial pressure. When you dont have enough, the easiest method to cope is to borrow money.

These structural realities are sad and worrying, but it also gives us a guide on how to invest in Malaysia. 3 investment areas that we can explore:

Consumer stocks

Financial Services

Plantation

Be a paid subscriber to read the rest of the article!

You can unlock paid subscriber-only contents & perks such as exclusive group chat and offline community meetups when you join the Community Subscription.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Access to DoitDuit portfolio

- • Offline community meetup every month

- • 1-2 exclusive content sent to you via email every week

- • Groupchat exclusive for paid subscribers on Telegram

Reply