- So, this is adulting by DoitDuit

- Posts

- Hartalega: Can the Malaysian Glove Sector Turnaround from here?

Hartalega: Can the Malaysian Glove Sector Turnaround from here?

Key takeaways from Hartalega’s investor briefing and AGM, including their market outlook. Near term remains challenging, but Hartalega is optimistic that demand will continue its healthy growth in the coming years. Still, there’s no solution to the oversupply situation yet

Disclaimer: This article is in no way financial advice, nor solicitation to buy or sell shares in this company. It is purely for educational purposes only. You are highly recommended to conduct all necessary due diligence and make your own informed decisions before making any financial decisions. The writer does not own shares in this company and may at any point in time increase or reduce their position without prior notice. Do not try to copy trade!

Once upon a time, there was Hartalega

Historically, Malaysia was the global leader in the glove industry. It all started back when Hartalega developed:

the first nitrile glove to overcome latex allergies with traditional rubber gloves; and

the first double former dipping lines we widely see being used today.

For over a decade after that, Hartalega, alongside Topglove and Kossan (forming the Big 3 glove players), enjoyed steady growth almost every year with little competition in the global markets.

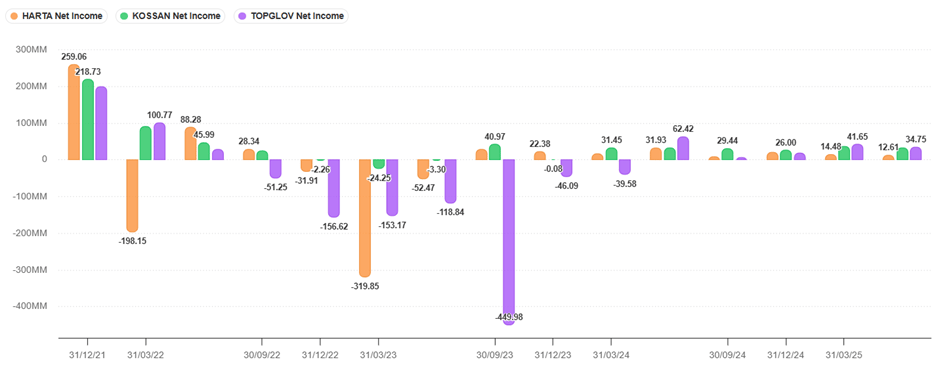

The Covid-19 Pandemic was both a blessing and also a curse to the glove industry. In the two years of the pandemic, Hartalega made more profit than they had cumulatively made throughout their whole history. This gross amounts of profit brought China into the picture, and that’s where things started going downhill.

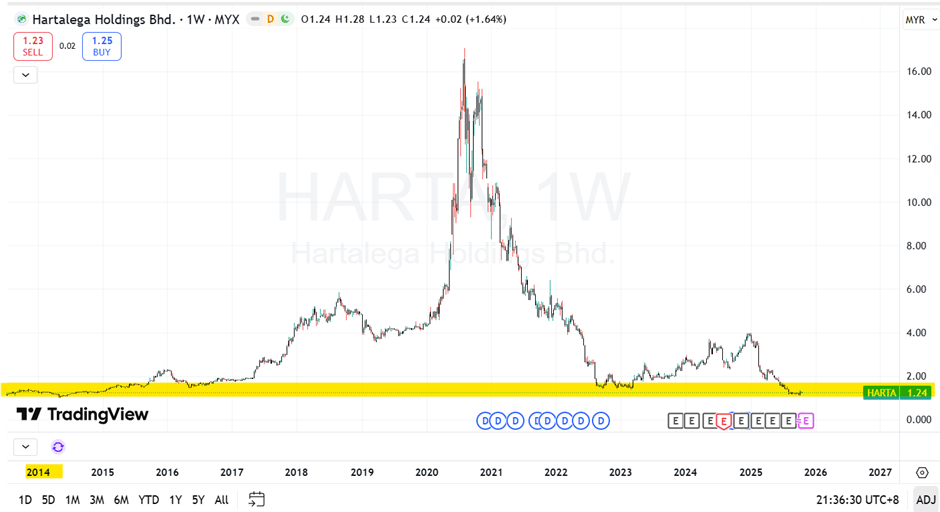

Hartalega is at 2014 price levels after adjusting for dividends

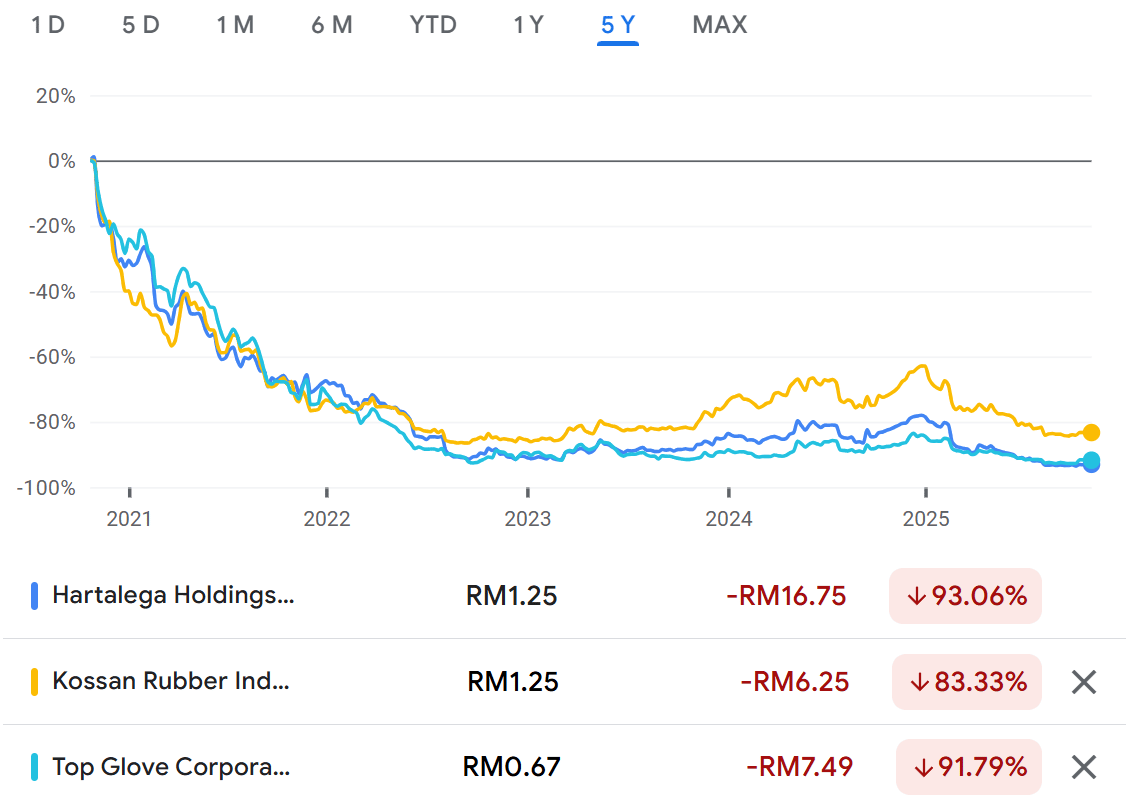

Today, the Malaysian glove manufacturers are struggling to maintain their global leadership in this industry. It is not easy to balance between keeping market share while maintaining profits in an industry filled with excess capacity from China and rising costs of production in Malaysia.

In light of this oversupply situation, share prices of the Big 3 glove players fell to their lowest in over a decade.

In 2025, the Big 3 have mostly returned to profitability and are in much better financial position than before the pandemic, but market reaction has been lethargic at best.

Many people are saying that gloves have become a cheap value buy, with all negatives already priced in. But the same story has been repeating for the past 3 years, and all the while share prices continue to make new lows. Is this truly the bottom, or is there more downside ahead?

In this article, I will share my notes from Hartalega’s AGM as well as from a briefing session and share a few of my personal thoughts about this polarizing sector.

Be a paid subscriber to read the rest of the article!

You can unlock paid subscriber-only contents & perks such as exclusive group chat and offline community meetups when you join the Community Subscription.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Access to DoitDuit portfolio

- • Offline community meetup every month

- • 1-2 exclusive content sent to you via email every week

- • Groupchat exclusive for paid subscribers on Telegram

Reply