- So, this is adulting by DoitDuit

- Posts

- Foodie Media IPO Valuation; 11th Community Meetup; Q&A with Iherng

Foodie Media IPO Valuation; 11th Community Meetup; Q&A with Iherng

How to value Foodie Media IPO; Should we invest property when rental can only cover 80% of instalment; Where to get reliable property data?

Last Saturday, we had our 11th DoitDuit’s community meetup. It’s always nice to see all of you face to face. We are increasing the frequency of meetups from once every 2 months to once every month, given that the community has grown bigger.

Thank you for your support via the paid subscription, it’s our blessing and honour to have you. Investing and adulting are easier with a community.

If you haven’t join the paid subscription, you can a community of young and hardworking adults here: https://www.doitduit.com/upgrade

Foodie Media IPO

The main agenda for the 11th community meetup was the business and valuation analysis of Foodie Media, that is going to IPO soon. The exact IPO pricing details are not published yet, giving us an opportunity to analyse the company from a blank state, purely based on earnings power of the business.

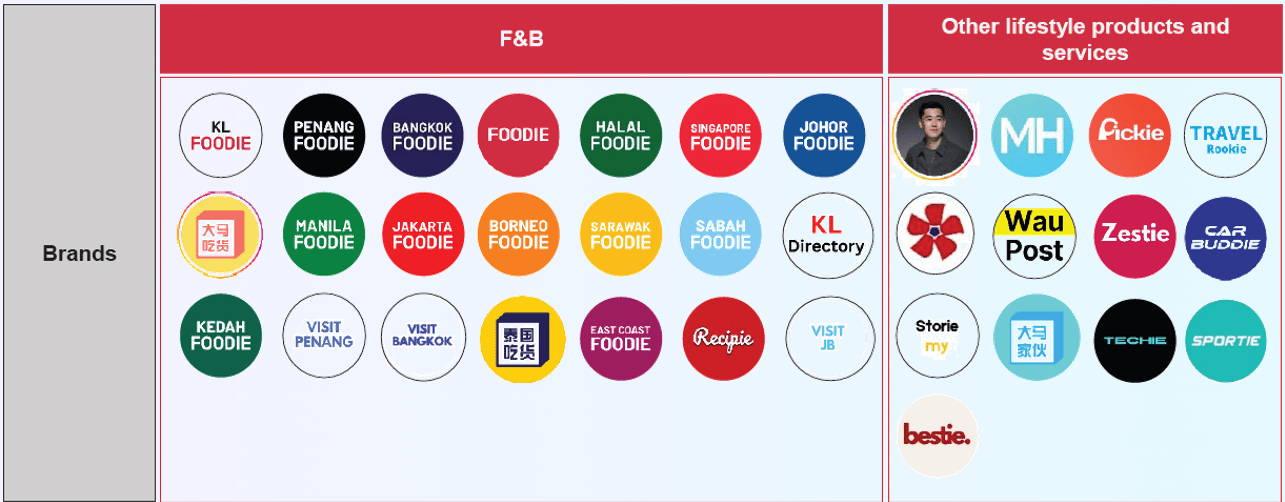

Foodie Media is a media/content creation company with a total of 34 different brands on social media. In total, all the brands has 44.2 million followers across all social media platforms, much more than Malaysia’s population of 34 million.

However, we note that there should be many overlapping in their followers because Foodie Media tends to collab post within their brands to redirect traffic from their more famous brands to smaller brands.

The early days of Foodie Media

The people behind Foodie Media are Pinn Yang (husband), Rui Mei (wife) and Pinn Jian (brother of Pinn Yang).

Pinn Yang started his career working with Tencent Malaysia and the project he worked on was to promote Malaysia food. However, Tencent Malaysia decided to focus on another music project, JOOX and discontinued the food project. Pinn Yang saw potential in the food project so he started Penang Foodie, and the rest in history.

Pinn Yang, Rui Mei and Pinn Jian scaled all the Foodie brands without focusing on personal branding and let the food be the content focus. This turned out to be a very good decision because they do not rely on any content creator to promote their food/products, making Foodie Media a relatively strong and sustainable media business.

The strength of Foodie Media is also their biggest weakness. When you do not have a strong content creator personal branding to support your online presence, you are seen as “replaceable” and “not differentiated” from other page.

Understanding this, Pinn Yang started to build his personal branding since 2022, and became the face of Foodie Media. This is a good move for Foodie Media because you now have a CEO that is invested in the business, while “humanising” the company brand.

Today, Pinn Yang is very famous among the Malay community, especially on Tiktok with >5 million followers. If you noticed there is a trend of influencers giving out money/gifts in Pavilion, he is the one that started this trend.

The management team behind Foodie Media today

All 3 of the founding team has specific role:

Pinn Yang is the Chief Executive Officer (CEO). He is the one who set the direction for the company.

Rui Mei is the Chief Operation Officer (COO), Pinn Yang’s wife. She is the one who manages all the operations of the company, supporting the vision of Pinn Yang.

Pinn Jian is the Chief Content Officer (CCO), Pinn Yang’s brother. He is the one who quality check all the contents before they go live on Foodie Media social media platforms.

In 2022, the Loo Family (family behind Tealive business) acquired 40% of Foodie Media from Pinn Yang, Rui Mei and Pinn Jian (and another early investor). The Loo Family became actively involved in the business, providing management support.

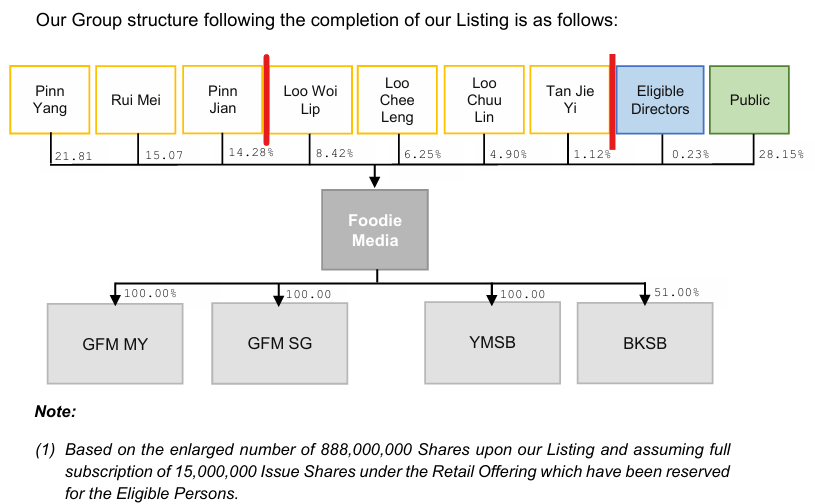

After the IPO, the shareholding structure of Foodie Media will be fragmented:

Original founders hold 51.16%, lead by Pinn Yang;

Loo family holds 20.69%, lead by Brian Loo Woi Lip; and

Public will hold 28.38%.

If you are looking to invest in Foodie Media, you should monitor this shareholding structure.

This is because it may pose a future risk, given that the shareholding of the original founders is only 51.16% combined and held individually. If any of the original founders has a breakup in their relationship (family or marriage), the majority control can be at risk.

Foodie Media Business

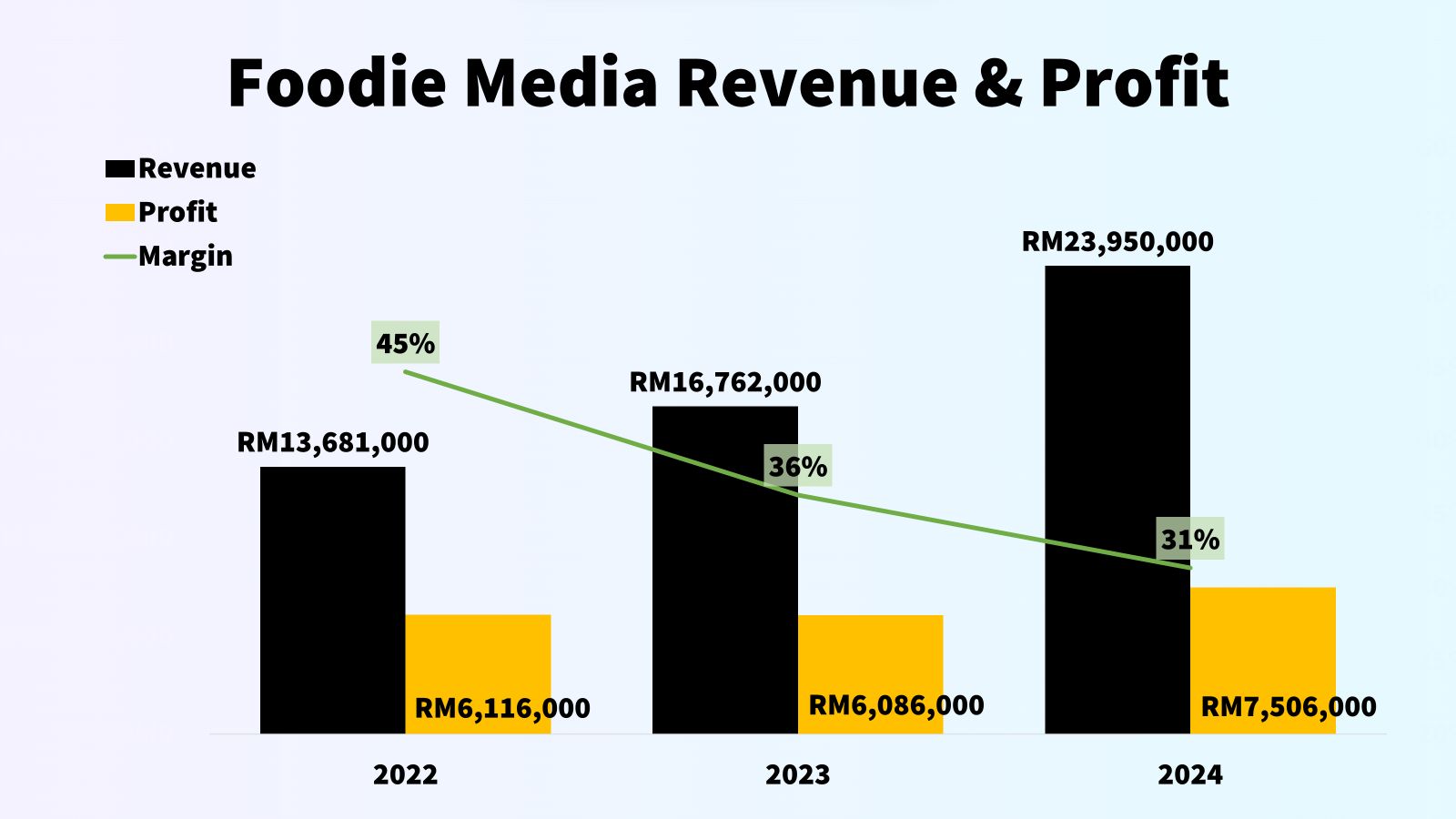

Revenue and profit of Foodie Media from FY2022 to FY2024 (Note that the financial year end at 31 August)

Foodie Media experienced strong growth with high profit margin.

2022 | 2023 | 2024 | 3 years CAGR | |

|---|---|---|---|---|

Revenue (RM’mil) | 13.681 | 16.762 | 23.950 | 20.5% |

Profit (RM’mil) | 6.116 | 6.086 | 7.506 | 7.1% |

Be a paid subscriber to read the rest of the article!

You can unlock paid subscriber-only contents & perks such as exclusive group chat and offline community meetups when you join the Community Subscription.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Access to DoitDuit portfolio

- • Offline community meetup every month

- • 1-2 exclusive content sent to you via email every week

- • Groupchat exclusive for paid subscribers on Telegram

Reply