- So, this is adulting by DoitDuit

- Posts

- Dutch Lady Milk: 60-year-old factory replaced with brand new integrated facility; Takeaways from the AGM and Investor Day

Dutch Lady Milk: 60-year-old factory replaced with brand new integrated facility; Takeaways from the AGM and Investor Day

Dutch Lady just completed RM600 mil CAPEX over the last 6 years to build and relocate to their new plant, which has double the production capacity of their former plant, with potential to double it again if the need arises. Hints at resuming higher dividend payout as no more major CAPEX is planned in the near future.

Disclaimer: This article is in no way financial advice, nor solicitation to buy or sell shares in this company. It is purely for educational purposes only. You are highly recommended to conduct all necessary due diligence and make your own informed decisions before making any financial decisions. The writer already owns shares in this company and may at any point in time increase or reduce their position without prior notice. Do not try to copy trade!

I bought some shares in Dutch Lady Milk Industries Berhad (DLADY) just to attend the AGM and join their investor day held in their brand new plant in Bandar Enstek. It’s an important milestone for the company that is facing increasing competition (largely by Farm Fresh) to maintain their market leading position.

With this new factory and more efficient production lines, I wanted to see if DLADY will be able to take more market share and cement their position as the de facto market leader in the space while maintaining healthy operating margins in the highly competitive dairy industry.

If you haven’t join the paid subscription, you can a community of young and hardworking adults here: https://www.doitduit.com/upgrade

From old plant in Petaling Jaya, to new plant in Negeri Sembilan

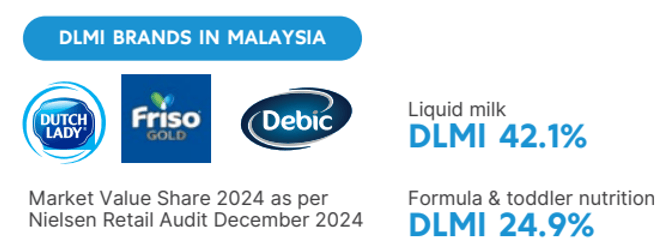

DLADY is ~51%-owned by Netherlands’ FrieslandCampina, which owns many major F&B brands around the world, especially on Dairy F&B products. In Malaysia, they mainly sell the Dutch Lady, Friso, and Debic brands.

Dutch Lady’s old PJ factory

DLADY was Friesland’s first overseas production facility, which was built in Petaling Jaya all the way back in 1963. That same plant, albeit with some upgrades and refurbishments over the years, served DLADY for over 60 years until just the end of last year where DLADY completed their relocation to their new plant in Bandar Enstek, Negeri Sembilan.

Understandably, the old plant was falling behind in terms of technology, efficiency, and production capacity, with limited space for expansion since there was no nearby land available at a reasonable price.

Historical dividend of Dutch Lady

Thus, in 2018, the management took the decision to cut dividends from nearly 100% payout ratio to about 30% in order to fund this major expansion. This of course led to a major selloff in their shares, as dividend focused funds were no longer seeing the yields they wanted and were forced to look for alternatives. Meanwhile, with production running at bottlenecks, growth funds also shied away as there was little growth to be expected during the time.

Historical share price of Dutch Lady

Thus, for about 6 years, DLADY’s share price slid down slowly as investors reallocated their investments into other stocks that could potentially have better prospects in terms of profit growth or dividend returns. However, with the near-completion of one of DLADY’s biggest capital expenditure, I think there’s a good chance for them to turnaround back into growth territory while also increasing dividends.

Selected financial numbers for the past 15 years

I took the liberty to compile a few key financial data from the annual reports since 2010. As typical for a majority foreign owned company, DLADY historically used to pay out above 90% of profit as dividends.

This makes sense, as the holding company cannot (or doesn’t want to) sell their shares or risk losing control of the company. Thus, the only way they can get realised profits from the business is via the distribution of dividends.

From DLADY quarterly report

However, the situation changed after DLADY allocated about RM600 mil for expansion. They cut dividends and used the money for capital expenditures instead while only paying out a minimum amount of dividends every year. The rest of the money went into PPE or non-current assets, mainly for the new plant.

Dividend to Operating Profit, Net Profit and Operating Cash Flow of DLADY

So, it stands to reason that once all the major CAPEX had been completed and all borrowings paid back, it is possible for DLADY to start increasing dividends again both as a percent of profit, as well as from potentially increasing profits from higher operational capacity.

Another point worth noting is that, the company started realising accelerated depreciation for the equipment from their old factory, since they decided that none of the old equipment will be brought to their new plant. This artificially suppressed the net profit numbers reported and had no impact on cash flows. As per the AGM, management said that the accelerated depreciation exercise has been completed, and all future depreciation will be priced in at the typical accounting treatment rate.

Another important highlight is that in 2021 they sold off the land and property of their old PJ plant for RM200 million, and recognised a one-off gain of ~RM179 mil. The gain was used to fund their capital expenditure.

The management did not give any dividend guidance other than that they intend to continue distributing dividends every year. DLADY’s management team is somewhat infamous among the investing community for not disclosing much information during the AGM about their operations for fear of competition, much to the frustrations of some shareholders.

With that in mind, I attended the AGM and subsequently was invited in their inaugural shareholder day held in their new plant.

Key takeaways from the site visit: Doubling capacity, with room to double again

One of the entrances to DLADY’s huge facility

DLADY’s 32-acre plant is located at Bandar Enstek, Negeri Sembilan. It’s a new industrial park development by Eco World, located ~15 minutes from KLIA. Surrounding them, many new factories are also being built or have already been completed, e.g. AJINOMOTO (AJI), Kellanova Malaysia (Kellogg’s), Tyson Foods (Supplier to McDonald’s, under MFLOUR), Signature International (SIGN) etc.

DLADY dont allow us to take photos of the inner workings of the facility and they were strict on this. Fortunately, I had the opportunity to speak with the factory manager, company secretary and a few other executives of the company.

DLADY’s facility is a fully integrated one with production facility, distribution center, and wastewater treatment plant. Currently, the buildings occupy ~70% of the total land area, with the vacant space earmarked for future expansion to double their production capacity again.

Currently, the plant’s full operating capacity is double that of their old PJ plant, so with the potential to double it again means that in the long term, DLADY is planning to quadruple their previous operating capacity. However, at the current moment, this new facility is only running at about 60% utilisation rate (which is already higher production than before).

Photo taken from the Annual Report

The production lines are 100% automated, from production, filling, packing, and sorting. They claimed that this is the first of its kind in Asia. They also claimed to be using a special kind of packaging (first of its kind in Malaysia) which ensures the quality of the finished goods and the recyclability of the packaging.

Production line of DLADY by BERNAMA

They only have 1 worker per line on standby, but the workers themselves are not involved in the production of the goods. For a company generating over a billion ringgit in sales, they only have about 460 employees. This puts them on par with some of the best companies in the world. Honestly I was quite impressed with the robotics involved in the lines.

Out of the 8 lines currently in operation:

6 are for producing UHT products;

1 for pasteurised products; and

1 for soft serve.

2 of the UHT product lines are for producing 200ml milk for the school dairy project by the Ministry of Education. Interestingly enough, DLADY said that their milk is supplied to schools in Sarawak. They also explained that the UHT lines can produce up to 24,000 cartons per hour, while the soft serve line can produce up to 10,000 cartons per hour. Again, the staff were proud to declare that these were the fastest of its kind in the market, which explained their high initial investment costs.

Some of DLADY’s professional line of products that are supplied to restaurants and cafes. We were offered to taste test many of their products, and in general I would say they taste good.

While exact product breakdowns were not given, the staff explained that their major revenue source is from UHT products, followed by pasteurised products, then soft serve.

They mainly sell to retailers, e.g. 99SMART, AEON, Lotus’ etc, and not really Direct to Consumers (DTC) although they do have DTC channels like e-commerce. Recently, they have also started to step up their penetration into the HORECA (HOtels, REstaurants, and CAfes) segment via their Professional line, supplying dairy products and ice cream to cafés and certain restaurant chains.

While not officially confirming this, they hinted that Secret Recipe, McDonald’s, Burger King, Gigi Coffee and CHAGEE are a few of the chains they supply to, although it is not exclusive contracts. They also offer consultancy services for smaller cafes to come up with menus which use their products.

Products that DLADY’s in-house professional consultant team creates for Cafes. They also have butter sheets for croissants, cream cheese etc, for professional use.

DLADY mainly sells their products locally, while export sales amount to about 5% of total sales. This number was historically restricted due to lack of production capacity so, going forwards, they will be exploring further increasing more exports. Currently, they export to Singapore, Vietnam, Indonesia, Brunei, Maldives, and Hong Kong.

The Distribution Center can store up to 25,000 pallets at a time. Typically, they only keep about 1 month of stock and it is their company practice to fully write off anything more than 4 months old. However, their inventory turnaround is high such that write offs rarely ever occur.

DLADY is the largest purchaser of fresh milk produced in Malaysia, mainly buying from partner farms and via the Department of Veterinary Services’ (DVS) Milk Collection Centres. They are working together with DVS to improve the quality and quantity of milk production amongst the local farmers, by introducing Dutch farming techniques to promote sustainable milk production via their Farmer2Farmer programme. They said that DVS has been very supportive as this is in-line with Malaysia’s goal to be self-sufficient in dairy production by 2030.

Unlike other companies like Farm Fresh, DLADY does not carry out upstream farming themselves and they mentioned that they have no intention to venture there for now. Notably, RHONEMA as I’ve written about before, and also F&N are new entrants into the upstream dairy market.

Market share research of Liquid Milk Products from the DLADY’s AGM. Based on my knowledge and speculation, Company A could be Farm Fresh, B: Nestle, C: Etika (Goodday milk), D: Malaysia Milk (HL Milk), and E: F&N

All the Dutch Lady “Fresh Milk” line is sourced from local milk. They do import milk powder from their parent company to make their other dairy products. Growing the raw fresh milk supply in Malaysia is challenging and a work in progress, but so far DLADY does not foresee any trouble securing enough milk for their production needs as they have various contracts and agreements in place.

ESG Matters

DLADY places heavy emphasis on ESG in their operations in every part of the supply chain. Currently, 100% of all their palm oil, cocoa, and packaging products are certified sustainable. Their partner farms are also practicing sustainable dairy farming.

One impressive feature is that their plant, as big as it is, does not contribute any waste to landfills. All waste are either recycled or made into compost.

Similarly, DLADY does not aim to have maximum profit at all costs in their mission to provide nutrition to everyone. Instead, cost savings are intended to be passed on to consumers, such that DLADY maintains a certain level of profit margins for the business, while at the same time keeping their products affordable for consumers. As much as possible, DLADY intends to limit upwards price adjustments if they can (but will do so if necessary).

Future plans: New plant open up opportunity for growth

DLADY does not expect any more major CAPEX plans for the near future. Currently, their focus is to introduce more product lines and increase the utilisation of the current plant by ramping up production. Potentially, they could look to bring in more brands from their parent company however their focus is very much on Dutch Lady products for now.

DLADY mentions that this new plant is expected to be the Halal Excellence Center for the FrieslandCampina group. This actually opens up a huge market as the global demand for Halal food products is growing, according to some market research, at double digits CAGR over the next decade. The new plant is already Halal certified and audited in Malaysia; and generally Malaysia’s Halal certification is recognised in most countries around the world.

Closing Thoughts and Evaluation: Divergence with Farm Fresh

Historical operating profit and net profit of DLADY

DLADY is a time tested company in Malaysia with proven track record of profitability for many decades. One thing I like is that the company does not carry out any dilutive activities and they fund any projects by internally generated funds, showcasing strong management of the company and shareholder friendly policies.

Dutch Lady (green) vs Farm Fresh (red) share price

The closest competitor to DLADY is no doubt Farm Fresh Berhad (FFB), the darling child of Malaysia’s home grown milk story. Mr Loi, the founder, is a very capable person and spearheaded FFB’s growth from a small scale milk farm and processing plant into what it is today. I actually like FFB’s growth story very much and I find Mr Loi to be a very inspiring person.

Revenue of Dutch Lady vs Farm Fresh Berhad

Yet, in spite of all FFB’s growth, acquisitions and very favourable tax treatment, FFB is still smaller than DLADY in terms of market share and sales of dairy products. However, FFB, with market cap of almost RM3.3 bil, is worth nearly 2x of DLADY in the market! That’s something to really think about.

DLADY’s financial numbers today and in the recent years look boring. As at 4 August 2025, DLADY is valued at:

Market Cap | RM1.75 billion |

|---|---|

Return on equity | ~20% |

PE ratio | 18x |

Dividend Yield | 1.8% |

It is neither particularly cheap nor expensive, though it is in the lower range of their historical valuations of closer to 30x PE.

Historical financials of DLADY

However, with the completion of their major CAPEX and impending ramp up of production, we could potentially start seeing significant revenue (and profit) growth again. Another potential driver is resumption of high dividend payouts as per pre-2018 years.

From a consumer point of view, if you go to many of the retail channels, you can actually see that DLADY milk products are now comparable, if not cheaper, to FFB products. The good thing about consumer companies is that you can easily check data points on selling prices with your own eyes.

All in all, I think DLADY is in a good position for the investing community to start paying attention to them again after down-trending and laying low for over 6 years.

I hope this was insightful to you!

If you have any questions (except target prices), feel free to ask in the comments section, or in the group chat and I will try my best to address them.

Stay safe and stay strong investing.

Best Regards,

Ren 🗿

DoitDuit

Disclaimer: This article is in no way financial advice, nor solicitation to buy or sell shares in this company. It is purely for educational purposes only. You are highly recommended to conduct all necessary due diligence and make your own informed decisions before making any financial decisions. The writer already owns shares in this company and may at any point in time increase or reduce their position without prior notice. Do not try to copy trade!

So, this is adulting is intended for a single recipient only, but occasional forwarding is totally fine! If you would like to order multiple subscriptions for your team with a group discount (minimum 5), please contact us directly.

Thanks for being a subscriber, and have a great day!

Reply