- So, this is adulting by DoitDuit

- Posts

- Defensive Monopoly Riding Secular Growth Trend: PBA (Perbadanan Bekalan Air Pulau Pinang)

Defensive Monopoly Riding Secular Growth Trend: PBA (Perbadanan Bekalan Air Pulau Pinang)

PBA is hitting a historic growth inflection point. With the new Tariff Setting Mechanism ending a decade of stagnation, this defensive utility monopoly is poised for record profits as it fuels Penang’s booming semiconductor hub. Is PBA an undervalued gem or a looming value trap?

Disclaimer: This article is in no way financial advice, nor solicitation to buy or sell shares in this company. It is purely for educational purposes only. You are highly recommended to conduct all necessary due diligence and make your own informed decisions before making any financial decisions. The writer owns shares in this company and may at any point in time increase or reduce their position without prior notice. Do not try to copy trade!

Penang is the 2nd smallest state in Malaysia, but one of the biggest contributor to Malaysia’s trade surplus. Penang is also often among the top states receiving foreign investments, especially in the E&E and semiconductor segments.

Batu Kawan Industrial Park

Many of the biggest companies in the world, such as Intel, AMD, Dell, Micron, Broadcom, B. Braun, Jabil etc have major plants in Penang, mainly concentrated around the Bayan Lepas Free Industrial Zone and Batu Kawan Industrial Park. In fact, Penang contributes ~5% of the semiconductor sales in the world, which lead to them gaining the moniker of “Silicon Valley of the East”.

Without going into too much details, allow me to postulate that increasing economic activity and population lead to increasing demand for water and energy. At the very least, for continued economic activity, water and energy usage will no doubt be required.

As an investor in Malaysia, there aren’t many ways to get exposure to this defensive industry. There are only 2 listed companies that are directly involved in the water distribution in Malaysia, which are PBA from Pulau Pinang, and Ranhill SAJ from Johor.

Name | Market Cap | PE Ratio | Dividend Yield | Price to Book | 1Y Returns |

|---|---|---|---|---|---|

PBA | RM650 mil | 4.5x | 2.3% | 0.56x | -3% |

RANHILL | RM2204 mil | 30.5x | 0% | 2.54x | +19% |

Data Taken as at 16 Jan 2026, numbers are rounded

The valuation discrepancy between the two companies are stark.

Brief Background on PBA

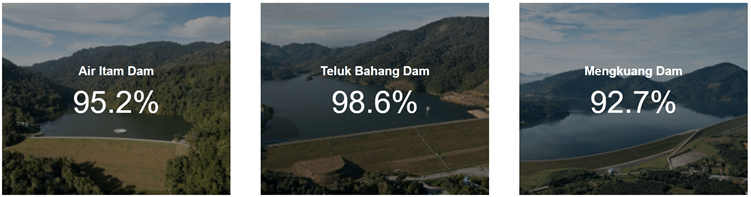

PBA is the sole licensed water operator of Pulau Pinang and is 65% held by the Penang State Government via the Penang State Secretary and Penang Development Corporation.

PBA get their revenue by selling treated water to end users like you and me (if we were from Penang), as well as to factories, businesses, and so on. Their main costs comes from the treatment raw water and distribution of treated water, including maintaining the pipelines, running the water treatment plants, and so on.

Be a paid subscriber to read the rest of the article!

You can unlock paid subscriber-only contents & perks such as exclusive group chat and offline community meetups when you join the Community Subscription.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Access to DoitDuit portfolio

- • Offline community meetup every month

- • 1-2 exclusive content sent to you via email every week

- • Groupchat exclusive for paid subscribers on Telegram

Reply