- So, this is adulting by DoitDuit

- Posts

- COASTAL: Selling Below Net Cash but Still Growing

COASTAL: Selling Below Net Cash but Still Growing

Coastal Contracts trades at 0.4x book value and 0.8x net cash (~RM950 million) following the successful collection of previously written-off receivables. Market sentiment is improving as major client PEMEX’s credit rating was upgraded to BB+ with stable outlooks. The company recently secured a US$1.14 billion (RM4.64 billion) gas project, boosting its total order book to RM7.5 billion through 2035. With RM190 million in new shipbuilding orders and a 25% JV dividend payout policy, COASTAL looks fundamentally undervalued.

Disclaimer: This article is in no way financial advice, nor solicitation to buy or sell shares in this company. It is purely for educational purposes only. You are highly recommended to conduct all necessary due diligence and make your own informed decisions before making any financial decisions. The writer owns shares in this company and may at any point in time increase or reduce their position without prior notice. Do not try to copy trade!

Preamble

In one of my recent article (https://www.doitduit.com/p/asia-file-corporation-berhad-profitable-cash-generative-and-dividend-paying-company-trading-below-ne), I briefly screened for profitable companies trading below net cash that paid dividends.

COASTAL was the largest company by market cap in the list but also the most discounted in terms of net cash to market cap at the time.

Brief Background on COASTAL

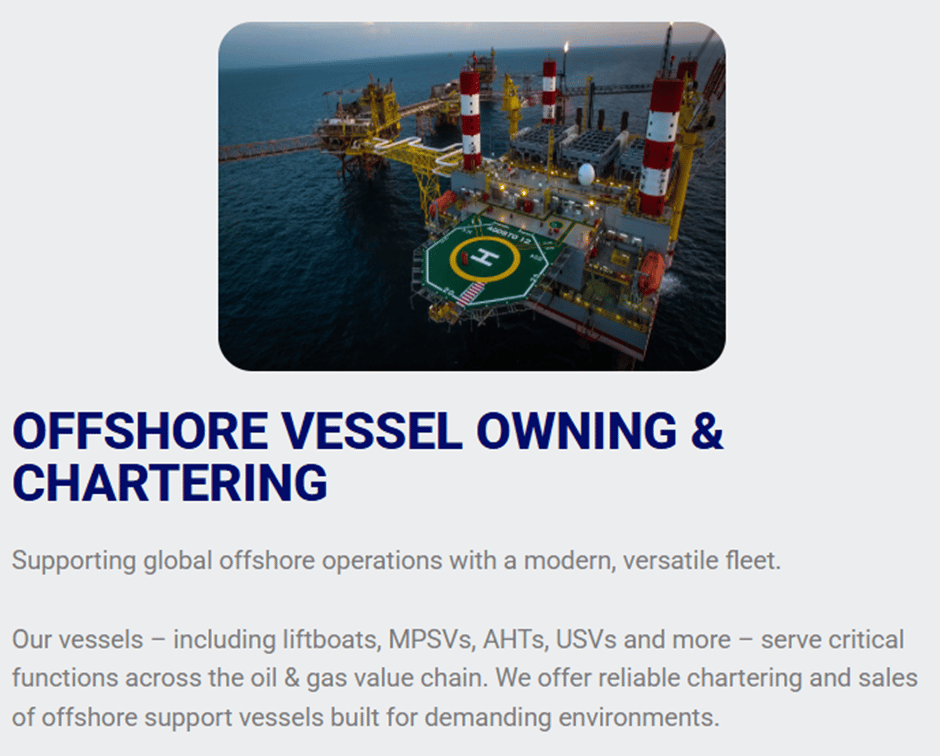

COASTAL is a Sabah-based company that has been operating in the Oil & Gas supply chain for about 45 years. Their business started off with vessel chartering, where they provided something like a rental service for their marine Offshore Support Vessels (OSV).

Subsequently, they expanded to include shipbuilding as part of their competency, and transitioned their OSV business into a build-then-sell model meaning, they no longer owned and managed the ships, but sold them to buyers instead.

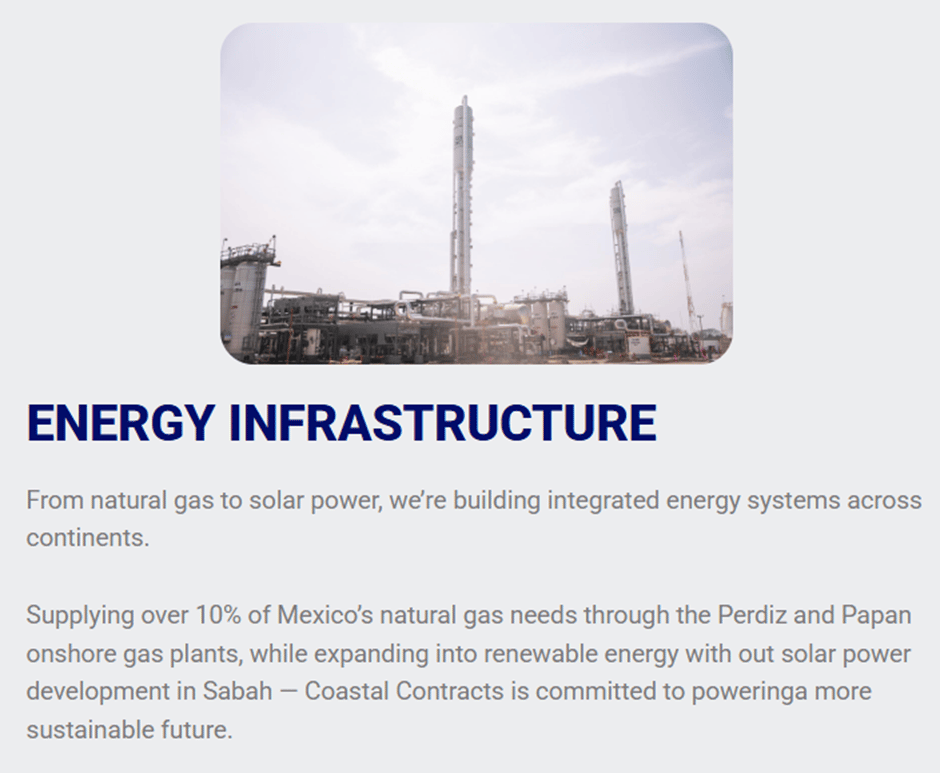

In 2014, COASTAL ventured further upstream into gas processing and began their first major work for Petroleos Mexicanos (PEMEX), which is the Petronas equivalent of Mexico, by contructing and chartering a Jack-up Gas Compression Service Unit (JUGCSU).

Subsequently, they secured more contracts with PEMEX under the gas processing business:

Perdiz Gas Processing Plant in 2021; and

Papan Gas Processing Plant in 2023 at the Ixachi oil field.

In 2024, COASTAL diversified into renewable energy sectors and hospitality:

Renewable Energy: Building a 15MW solar farm in Sabah; and

Hotel: Acquired 82% in Lepa Lepa resort at Semporna.

These ventures are so far still small compared to the rest of the business, especially the gas processing business.

Examining the corporate structure of the Gas Processing Business in more detail

This is an important point to understand COASTAL’s lumpy accounting and peculiar financial reports.

COASTAL’s Annual Revenue and Profit Numbers

As you can see, COASTAL’s net profit is very different compared to typical companies, with net profit margins often going over 100%. How can this happen? It basically boils down to accounting treatment.

COASTAL’s Corporate Structure

COASTAL’s major profit contributor is undertaken by their Joint Venture company called Coastoil Dynamics (CODY). COASTAL owns 50% of CODY, while the other 50% is owned by Alfair, a Mexican-based energy company.

Excerpt from COASTAL’s Q3FY26 income statement

Because this is a joint venture, COASTAL only reports “share of profit” from CODY, and does not consolidate the financials into their financial statements. This is a normal accounting treatment for JV companies.

Whatever bottomline number is reported by CODY, then COASTAL will take 50% of that number which will be attributable to COASTAL. For example, in the above excerpt of the quarter result, COASTAL’s share of profit of JV is about RM26.6 mil. This means that CODY’s net profit was actually RM53.2 mil at the JV level, and 50% of that profit is attributable to COASTAL while the other 50% goes to Alfair group.

Why does COASTAL trade below its net cash?

As I mentioned before, usually such situations arise due to extreme pessimism about future prospects of the company, and concerns about the potential cash burn rate going forwards.

CODY’s Papan Gas Processing Plant

O&G infrastructure are huge capital intensive businesses, as we know from studying YINSON before, and so this meant that COASTAL had to incur large startup costs to build the gas processing plants before getting paid. This also meant that COASTAL’s financial performance was heavily reliant on their gas processing business with PEMEX.

It’s worth remembering that Mexico is a country with huge debts, and PEMEX is one of the most indebted companies in the world with nearly US$100 bil of debt.

COASTAL share price trend

Initially, after securing the big contracts from PEMEX, the market cheered COASTAL’s performance and share price rallied to a high of about RM2.60 per share. As the months went by and receivables started climbing with no sign of being collected, its share price started to slide down. Things became worse when COASTAL had to write off a huge chunk of their receivables due to long overdue missed payments from PEMEX.

This caused the market to lose confidence in COASTAL’s major business segment as well as Mexico’s ability to pay their debt. After all, overdue receivables could be written off again and the company at the time did not have any other major work from their other segments since they focused on building their gas processing business for the past 5 years.

The rapidly strengthening MYR also did not help, as COASTAL had to continually recognize FOREX losses since their businesses are mostly conducted in USD.

However, early this year, COASTAL had managed to collect most of the money owed to them, which led them to having cash and cash equivalents of about RM950 mil today after declaring a first special dividend of RM0.05 in March. The overall market may have missed this development and still think that COASTAL has no money.

Be a paid subscriber to read the rest of the article!

You can unlock paid subscriber-only contents & perks such as exclusive group chat and offline community meetups when you join the Community Subscription.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Access to DoitDuit portfolio

- • Offline community meetup every month

- • 1-2 exclusive content sent to you via email every week

- • Groupchat exclusive for paid subscribers on Telegram

Reply