- So, this is adulting by DoitDuit

- Posts

- [Audio] Q425 Market Outlook: Turning point in the market

[Audio] Q425 Market Outlook: Turning point in the market

13th Community Meetup Slides & Recording. US & China market continues its rally. AI spending shifts to hardware and infrastructure. Watch out for for a debt-fueled bubble and US efforts to boost Intel's semiconductor role, benefiting Malaysia.

Last week, we had our 13th Community Meetup on 20 September 2025. We discussed about our Q425 Market Outlook and Beyond.

The economy and stock market are in very interesting time. On one hand, everyone is feeling the pain of weak economy; on the other hand, the stock market is performing very good.

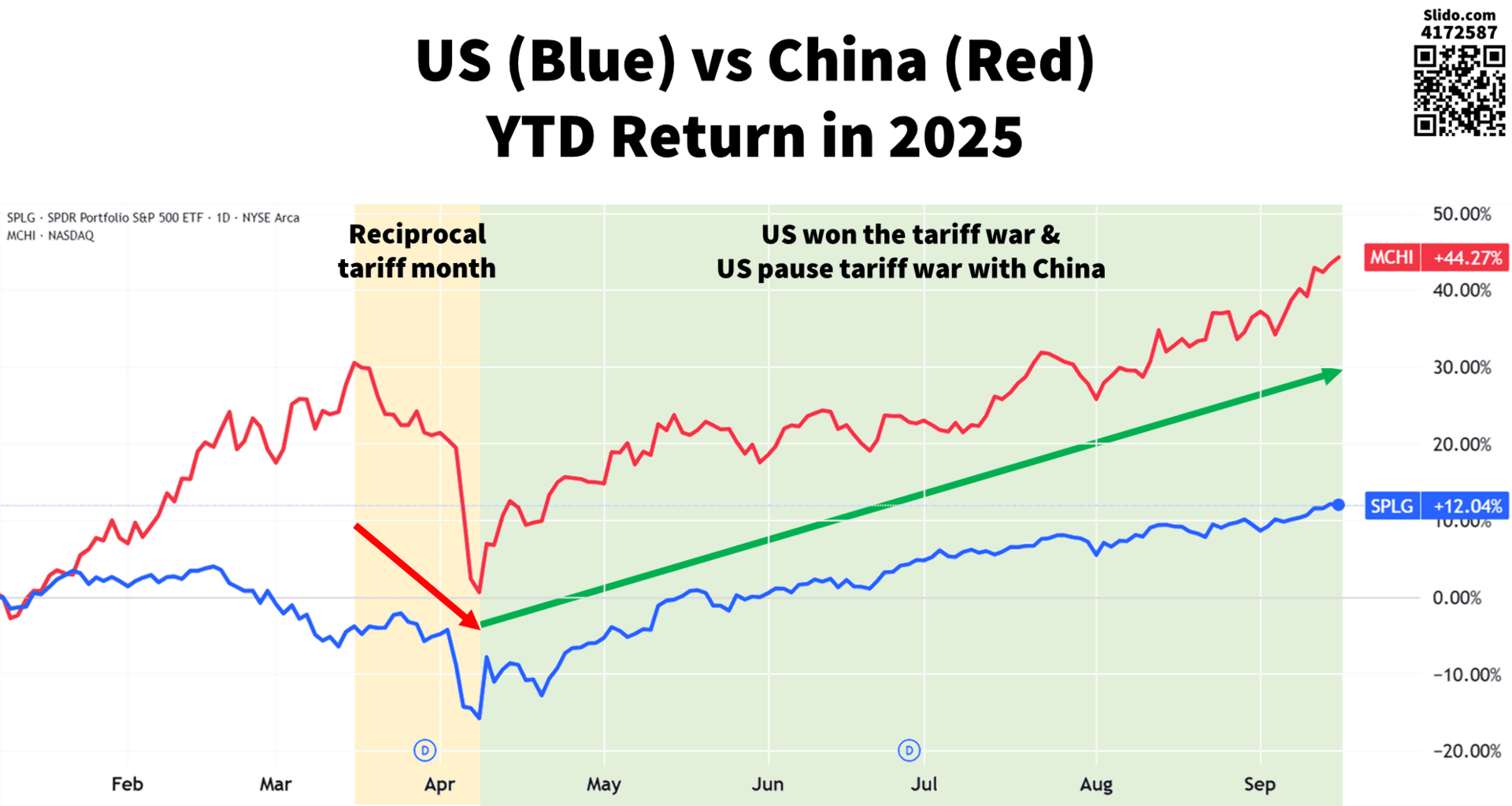

The US market (represented by S&P500) is hitting all time high, while the China market (represented by MCHI) is delivering 42% in 9 months of 2025. The biggest winners in the current economy are asset owners, and the biggest losers are normal people who keep their wealth in the form of cash.

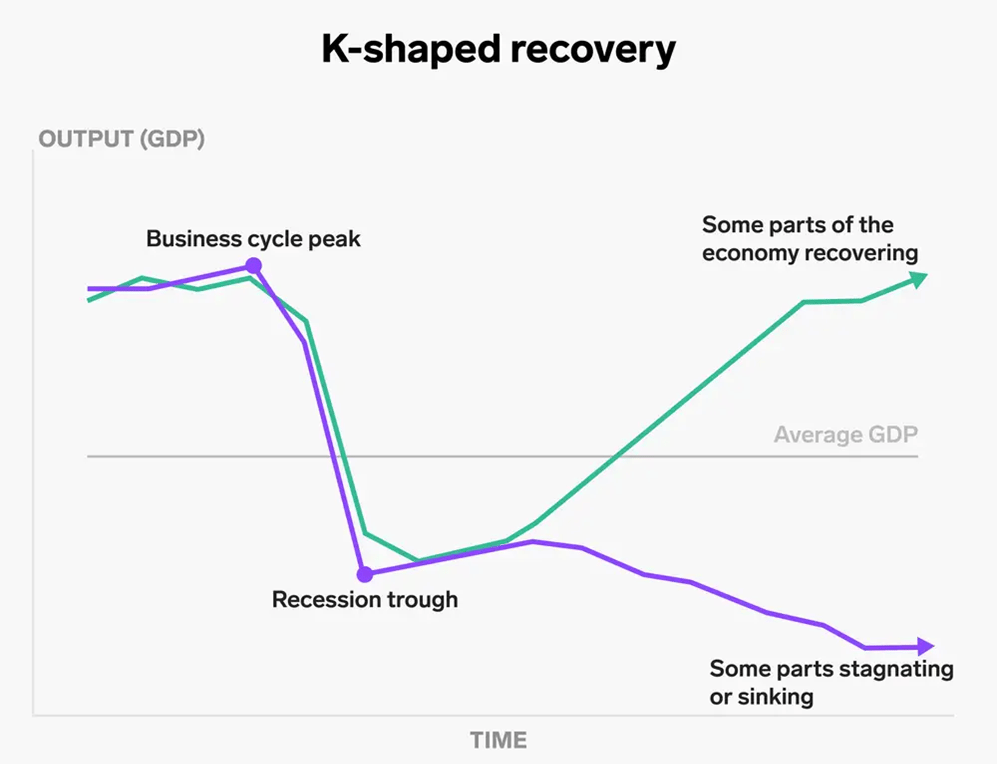

This is the K-Shape Economy we are living in, where the rich gets richer, and the poor gets poorer. This phenomenon is happening across the world.

K-Shape Economy

In a K-Shape Economy, some parts of the economy are very optimistic, while most parts of the economy are neutral/pessimistic. This is the result of capitalism and income inequality in the world, where the rich gets richer and the poor gets poorer.

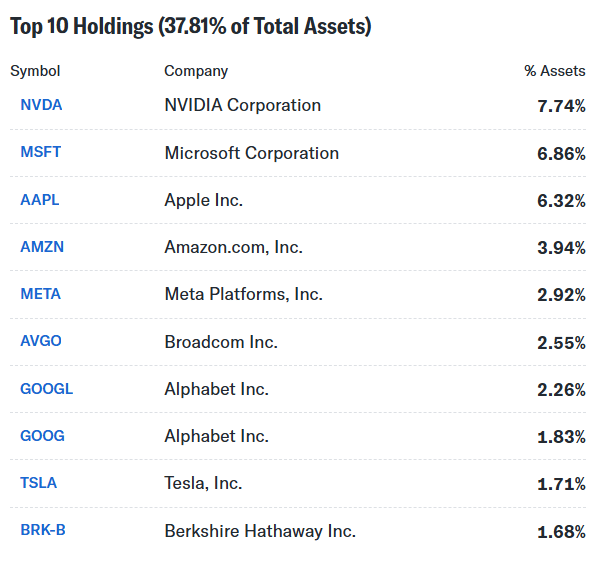

Today, the S&P500 is also experiencing the same kind of inequality, whereby the Top 10 companies in the S&P500 make up nearly 38% of the S&P500.

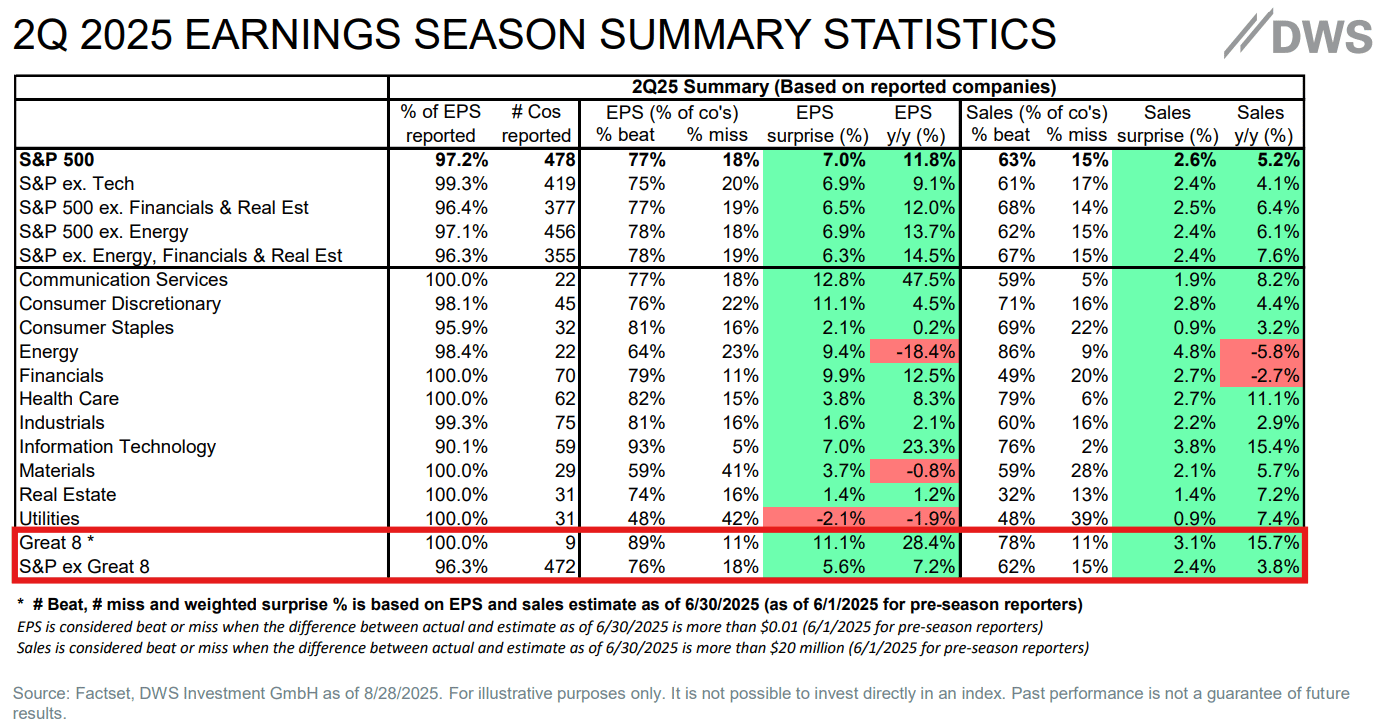

Great 8 refers Apple, Amazon, Google, Meta, Microsoft, Netflix, Nvidia and Tesla

These are the companies that are optimistic about the future, investing heavily into the economy, and generating profit growth (+28.4%) to S&P500. The rest of the S&P500 companies are doing ok, generating (+7.2%) of profit growth.

Q32025 is the Turning Point

Q32025 marks a significant turning point for the global economy, mainly because of 3 reasons:

The US has won the tariff war against the whole world, except China;

The US is in the process of creating a new S-Curve with AI; and

The US has successfully forced advanced manufacturing investment on US land.

We have touched on the observations above in our previous analysis:

We shared the following outlook/predictions in our previous meetups, which has materialised today:

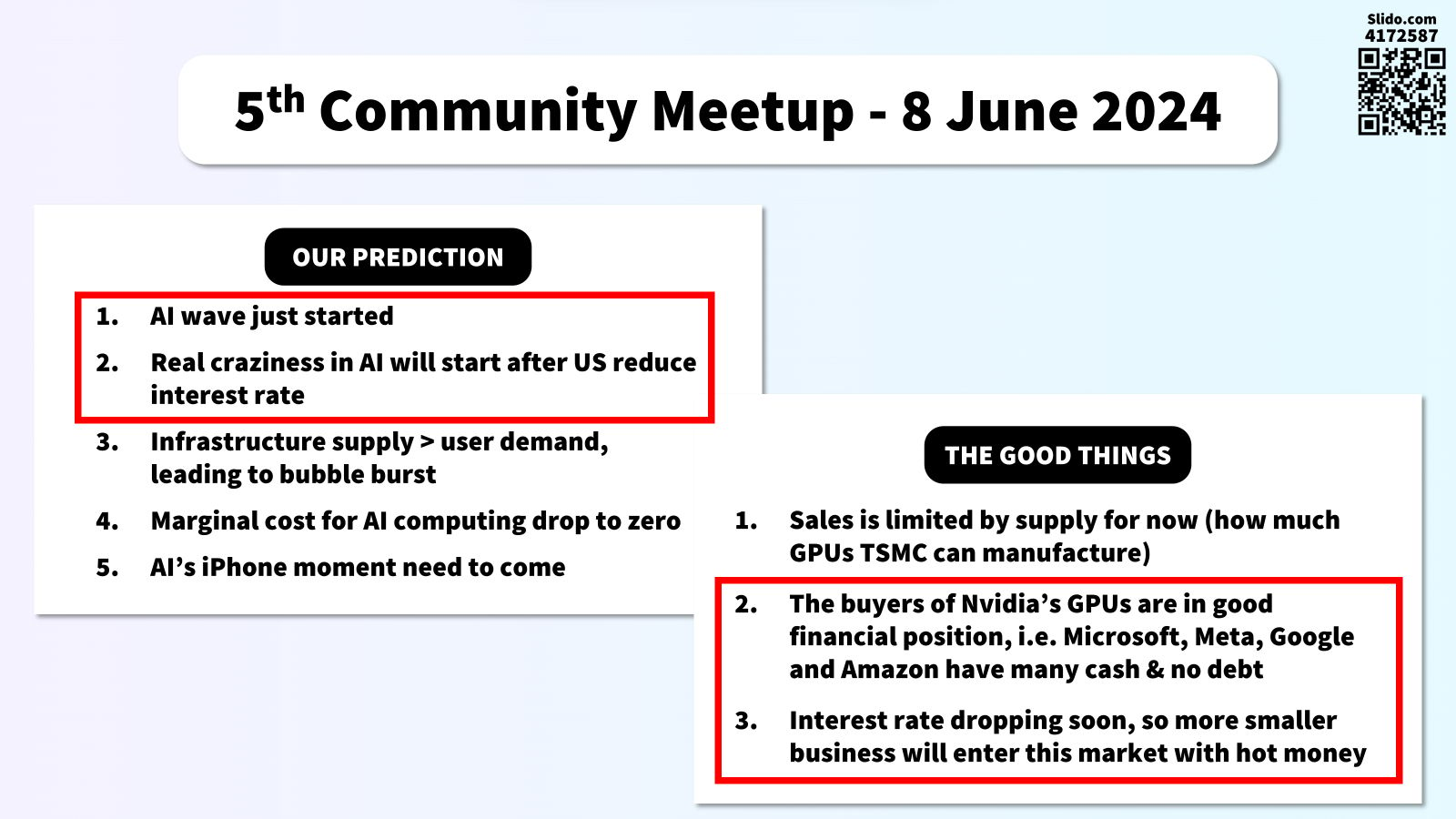

In our 5th community meetup held on 8 June 2024

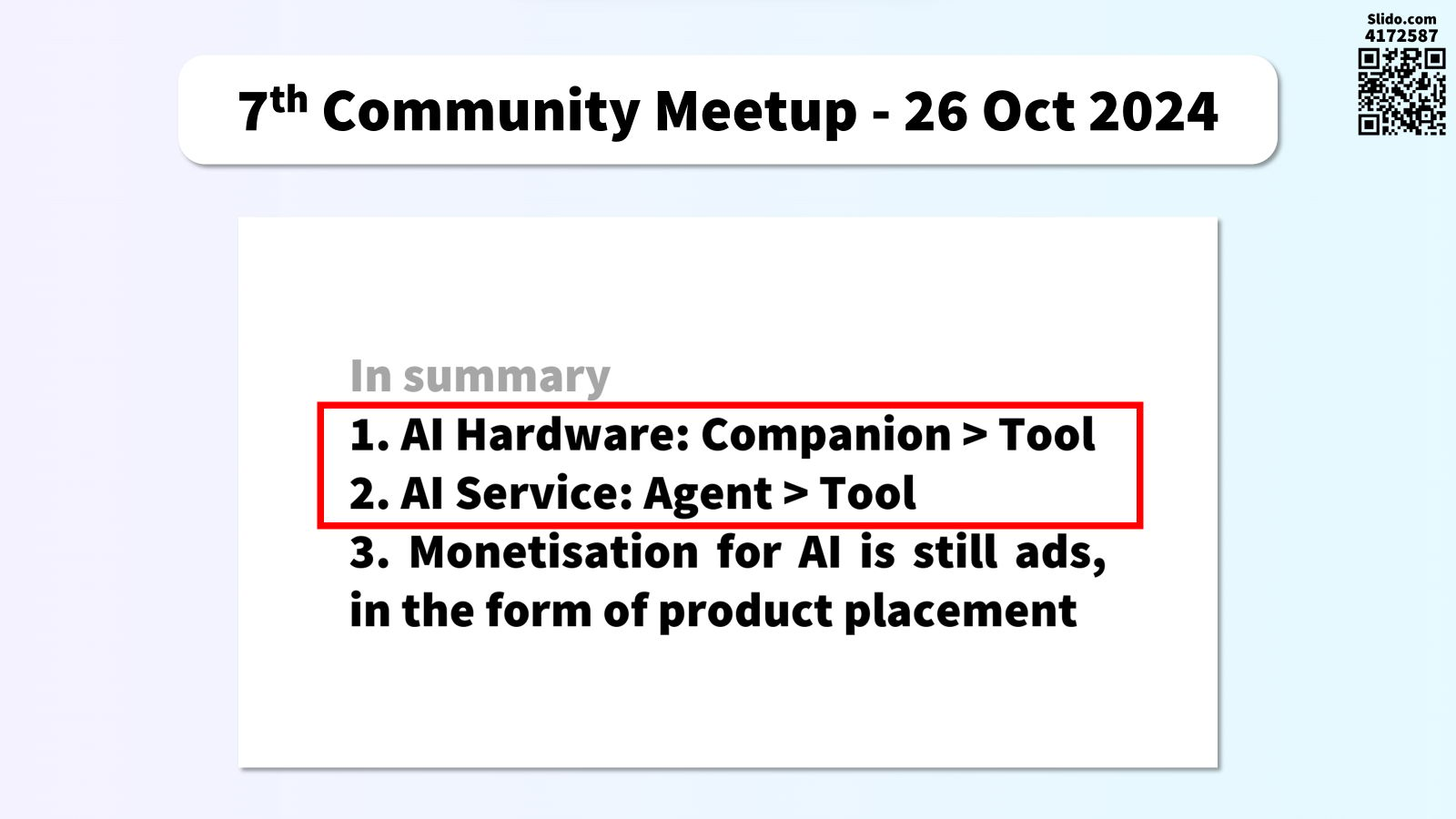

In our 7th community meetup held on 26 October 2024

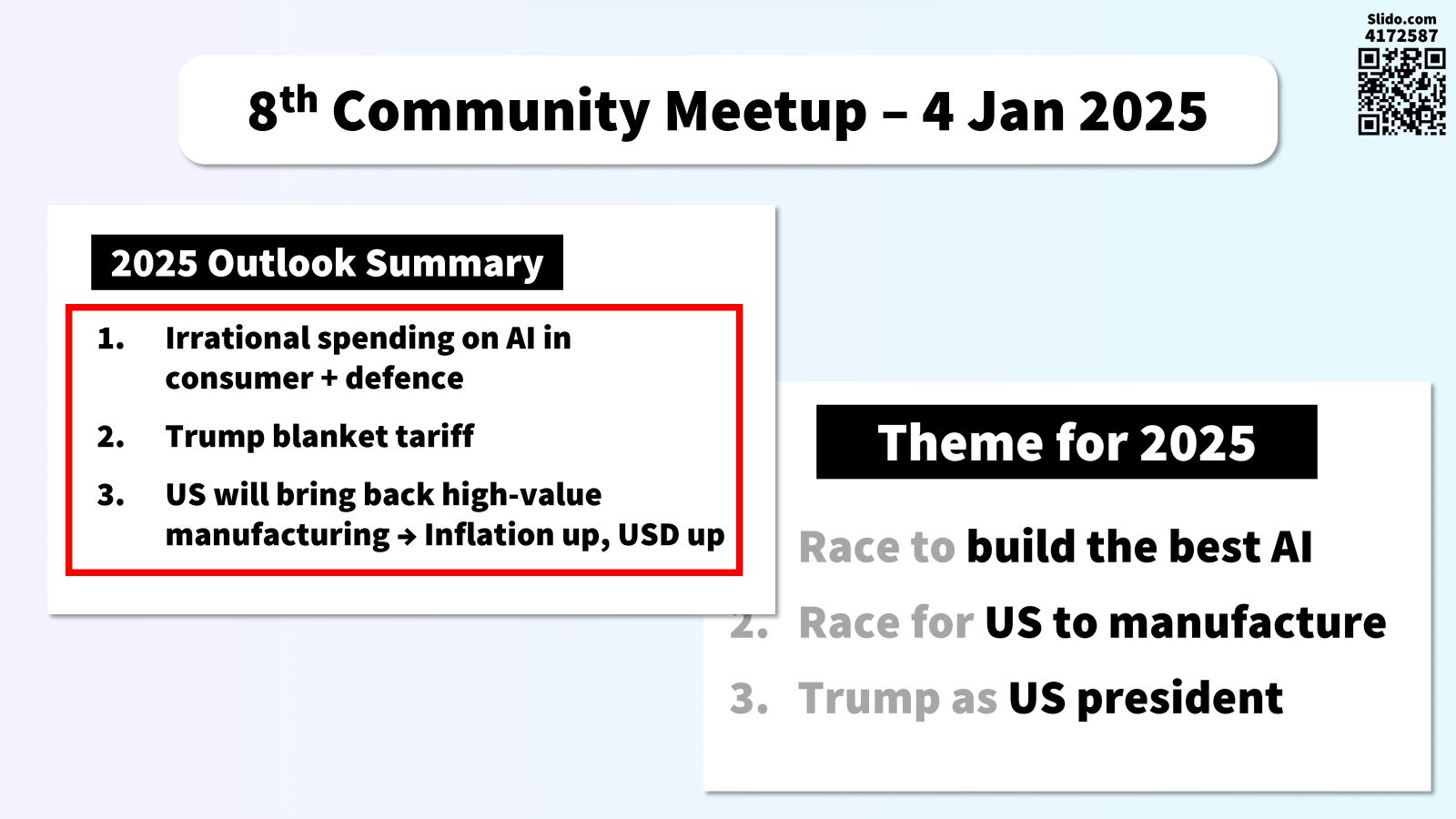

In our 8th community meetup held on 4 January 2025

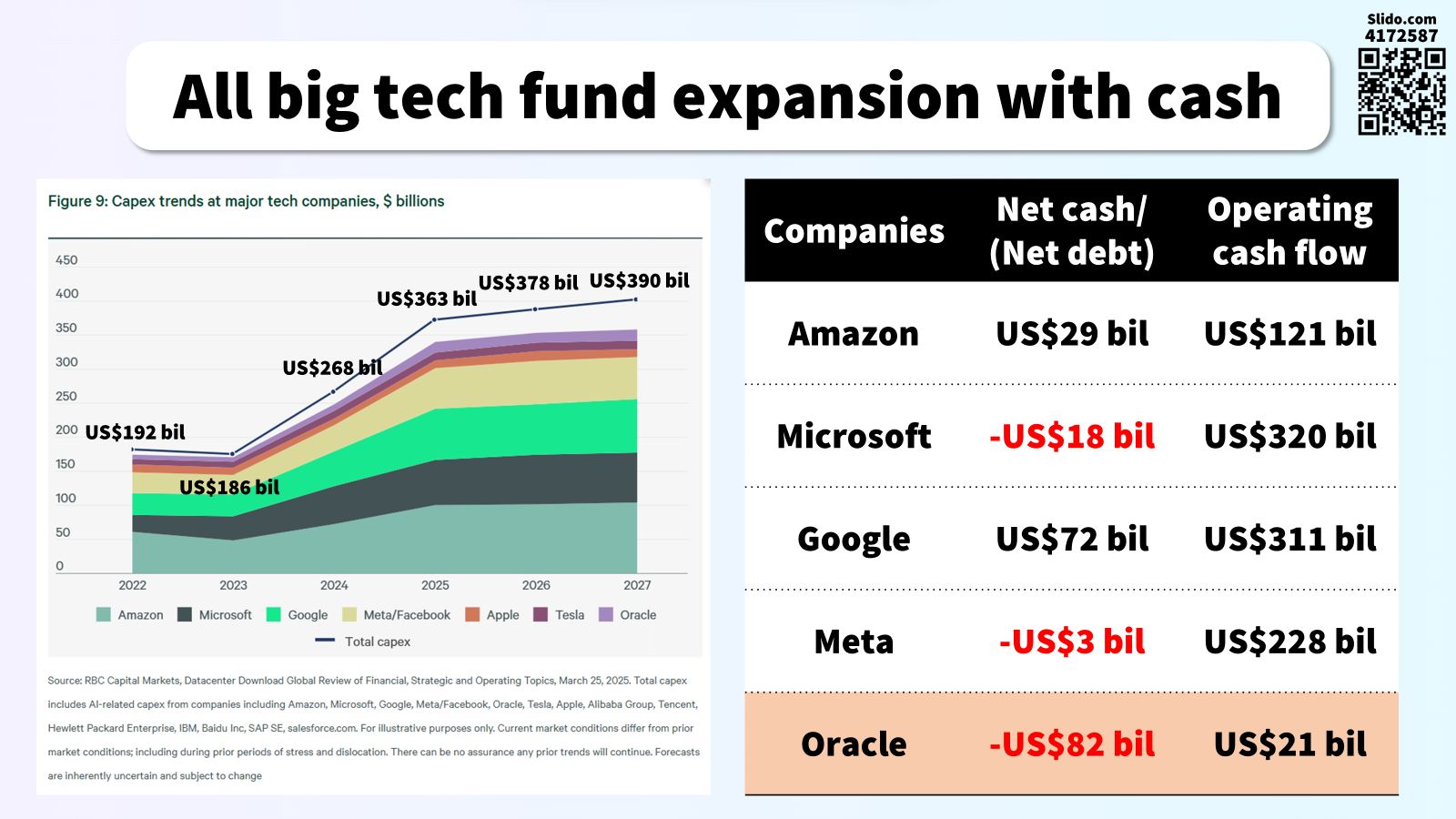

All in all, in the past 2 years, there were concerns that the big tech companies are fueling an AI bubble with their heavy investments into AI. We are not a believer of that because these investments are made with cashflow and their huge cash reserves.

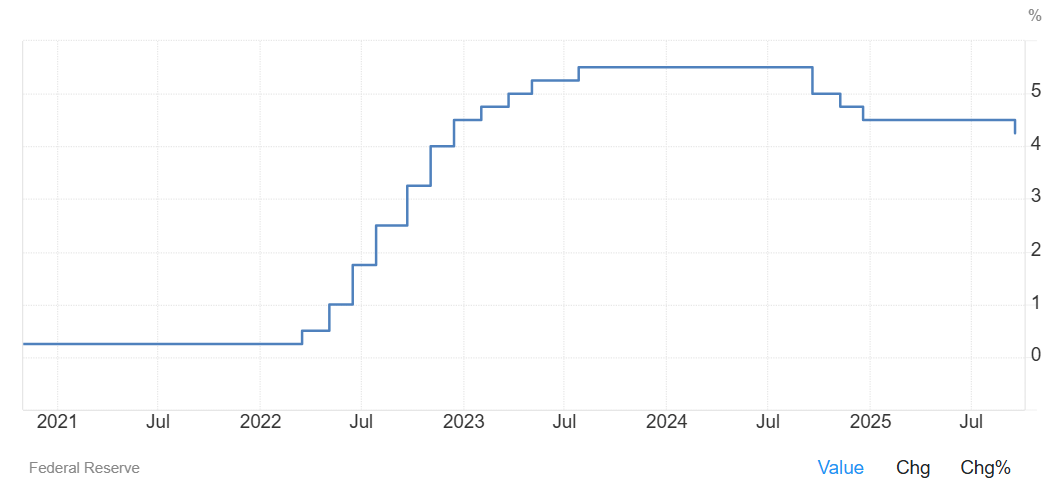

US Interest Rate of 4.25% now, is still hovering at relatively high range

Our thinking was that the real AI bubble will only happen when debt is involved, and expansion with debt will only happen when interest rate is low, like now.

Cashflow & cash position of all big tech companies

Oracle has entered the AI scene with huge load of debt, going from nobody to somebody in 1 quarter. One could argue that the potential of AI is so big that Oracle is willing to risk taking on huge loads of debt, just to get a pie of the AI market.

It will be interesting to see how other big tech companies respond to that. This could mark the turning point of how investments into AI will be financed. If more and more debts are involved, then the real AI bubble may become possible.

Be a paid subscriber to read the rest of the article!

You can unlock paid subscriber-only contents & perks such as exclusive group chat and offline community meetups when you join the Community Subscription.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Access to DoitDuit portfolio

- • Offline community meetup every month

- • 1-2 exclusive content sent to you via email every week

- • Groupchat exclusive for paid subscribers on Telegram

Reply